Forex Technical & Market Analysis FXCC Sep 24 2013

Forex Technical & Market Analysis FXCC Sep 24 2013

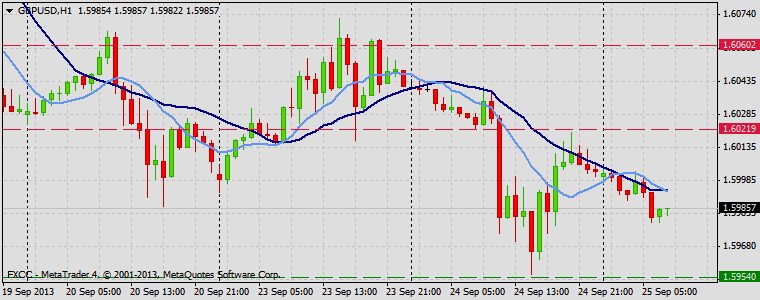

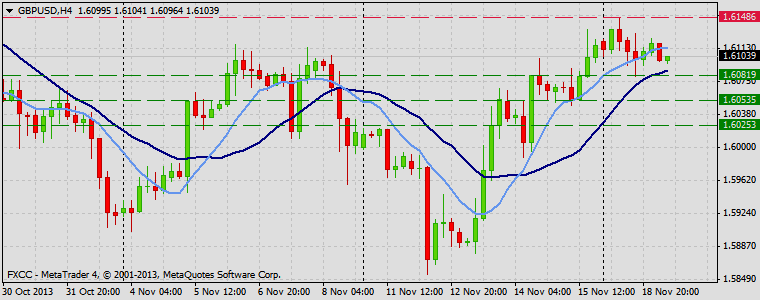

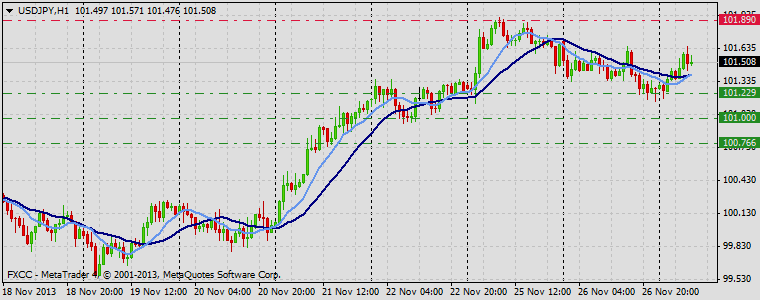

A tale of three central banks Two European central bank presidents spoke on Monday concerning their overall relative responsibilities. European Central Bank President Mario Draghi said he’s prepared to release another long-term refinancing operation in order to provide funds to Europe’s banking system if and when needed. Unlike previous times after Mr Draghi has held court, the market reaction this time was muted. The Swiss franc is still highly valued and the central bank’s currency ceiling remains essential for safeguarding the economy, according to Swiss National Bank President Thomas Jordan in his statement on Monday. Therefore the loose peg, in relation to the value of the Swiss franc versus the euro, at circa 120, will remain in force until conditions change. The U.S. currency fell versus the majority of its sixteen major peers as a consequence of the Bank of Atlanta President Dennis Lockhart and others stating that Fed policy should focus on creating a more dynamic economy. Lockhart has continually backed the Fed’s $85 billion in monthly bond purchases that were retained last week. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-09-24 08:00 GMT | DE IFO - Business Climate (Sep) 2013-09-24 12:30 GMT | CA Retail Sales (MoM) (Jul) 2013-09-24 14:00 GMT | US Consumer Confidence (Sep) 2013-09-24 22:45 GMT | NZ Trade Balance (YoY) (Aug) FOREX NEWS : 2013-09-24 05:16 GMT | EUR/USD churning above support of 1.3476 ahead of German data 2013-09-24 05:01 GMT | EUR/GBP struggles to maintain the 0.8400 support 2013-09-24 04:42 GMT | GBP/USD off slightly Tuesday after brief rally Monday; key support 1.5894 2013-09-24 03:59 GMT | USD/JPY pulling back away from 99.52 resistance as Yen sees safety inflows -------------------- EURUSD : HIGH 1.34985 LOW 1.3489 BID 1.34953 ASK 1.34955 CHANGE 0.02% TIME 08 : 47:25  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Appreciation above the resistance at 1.3517 (R1) might commence new step of the ascending structure. Our intraday targets today are placed at 1.3538 (R2) and 1.3560 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support level at 1.3478 (S1), only clear break here would be a signal of further market easing towards to next targets at 1.3458 (S2) and 1.3437 (S3) in potential. Resistance Levels: 1.3517, 1.3538, 1.3560 Support Levels: 1.3478, 1.3458, 1.3437 --------------------------- GBPUSD : HIGH 1.60443 LOW 1.60252 BID 1.60256 ASK 1.60261 CHANGE -0.1% TIME 08 : 47:26  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Market price penetrated below the moving averages and likely close at the negative side today. Our next resistive measure lies at 1.6054 (R1), break here is required to achieve higher targets at 1.6083 (R2) and 1.6109 (R3). Downwards scenario: Possible market weakening is protected by important technical level at 1.6016 (S1). Break here is required to open road towards to interim target at 1.5989 (S2) en route to final aim at 1.5962 (S3). Resistance Levels: 1.6054, 1.6083, 1.6109 Support Levels: 1.6016, 1.5989, 1.5962 ------------------- USDJPY : HIGH 98.93 LOW 98.662 BID 98.921 ASK 98.923 CHANGE 0.08% TIME 08 : 47:27  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: We expect possible upwards penetration. Break above the resistance at 98.93 (R1) would clear the way towards to higher target at 99.10 (R2). Further price appreciation would face then final resistive measure at 99.27 (R3) Downwards scenario: Our next support level locates at 98.63 (S1) mark. Possible penetration below this level would open way towards to next target at 98.47 (S2) and then final aim lie at 98.31 (S3) price level. Resistance Levels: 98.93, 99.10, 99.27 Support Levels: 98.63, 98.47, 98.31 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Sep 25 2013

Forex Technical & Market Analysis FXCC Sep 25 2013

Aussie, kiwi heavy; Tokyo stained with red Asian traders were rather inactive at the early going of Tokyo, with some Yen strength the main theme, yet as the session advanced, Aussie weakness also became dominant. In the US, following an uncertain and uneven Wall Street session after Fed’s comments on indefinite timing for bond-buying program, Asia registered mixed results in equity indexes with the Nikkei down 0.39%, pushing the yen higher. In New Zealand, the trade deficit expanded from $-771M to $-1191M beating estimates, for the worse, at $-743M. In Australia, the RBA said the banking system is liquid and in good shape and added the housing market data is strong and yet the Aussie remained heavy with slow progress upward. Japan prepared for the tankan results next week and market participants remain on their feet to any governmental decision to increase the sales taxes as Prime Minister Abe announce a potential increase based on tankan results despite the Spring 2014 plans to proceed with the monetary policies. In the futures contracts realm, all metals printed gains with notably copper advancing on positive Chinese consumer data along with gold registering gains worth 0.66% for the first time in the week to reach $1,325.00. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-09-25 06:00 GMT | DE Gfk Consumer Confidence Survey (Oct) 2013-09-25 10:00 GMT | UK CBI Distributive Trades Survey - Realized (MoM) (Sep) 2013-09-25 12:30 GMT | US Durable Goods Orders (Aug) 2013-09-25 14:00 GMT | US New Home Sales (MoM) (Aug) FOREX NEWS : 2013-09-25 05:05 GMT | EUR/USD threatening Tuesday low of 1.3463 ahead of Europe open 2013-09-25 04:47 GMT | USD/JPY has downside risks in coming months - JPMorgan 2013-09-25 04:24 GMT | AUD/USD is falling as “debt-ceiling” issue looms out 2013-09-25 03:36 GMT | Gold rallies off Tuesday low at 1305.50, but runs into wall at 1326.80 ------------------- EURUSD HIGH 1.34809 LOW 1.34619 BID 1.34719 ASK 1.34722 CHANGE -0.01% TIME 08 : 47:09  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Next resistive barrier locates at 1.3497 (R1). Violation here is required to provide a signal of further market strengthening. In such case, resistances at 1.3520 (R2) and 1.3542 (R3) acts as next attractive points for the bullish oriented traders. Downwards scenario: Further correction development might face next hurdle at 1.3458 (S1). Break here is required to open road towards to our next interim target at 1.3437 (S2), en route to final aim at 1.3415 (S3). Resistance Levels: 1.3497, 1.3520, 1.3542 Support Levels: 1.3458, 1.3437, 1.3415 ------------------- GBPUSD : HIGH 1.60039 LOW 1.59794 BID 1.59904 ASK 1.59911 CHANGE -0.07% TIME 08 : 47:09  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: A violation of next resistance at 1.6021 (R1) might call for a run towards to next target at 1.6060 (R2) and any further appreciation would then be limited to final target at 1.6097 (R3). Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.5954 (S1) is being able to drive market price towards to our next targets at 1.5912 (S2) and 1.5870 (S3). Resistance Levels: 1.6021, 1.6060, 1.6097 Support Levels: 1.5954, 1.5912, 1.5870 ----------------- USDJPY : HIGH 98.798 LOW 98.557 BID 98.680 ASK 98.682 CHANGE -0.06% TIME 08 : 47:10  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Neutral tone remains favored on the hourly chart frame, however possible extension above the resistive measure at 98.92 (R1) would suggest next intraday targets at 99.07 (R2) and 99.21 (R3). Downwards scenario: On the other hand, new phase of downtrend formation might commence below the important support level at 98.56 (S1). Break here is required to validate our targets at 98.41 (S2) and 98.26 (S3) later on today. Resistance Levels: 98.92, 99.07, 99.21 Support Levels: 98.56, 98.41, 98.26 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Sep 26 2013

Forex Technical & Market Analysis FXCC Sep 26 2013

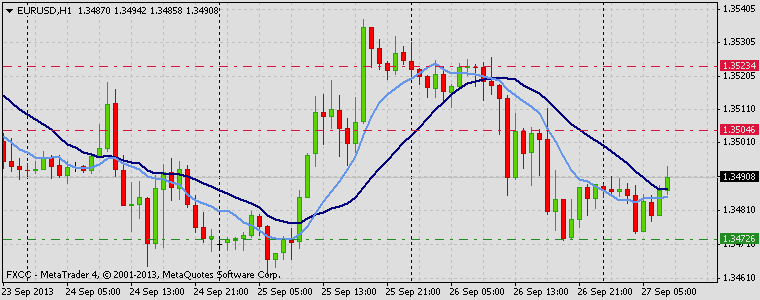

SPX drop longest since 'fiscal cliff' debacle of December 2012 The SPX has dropped over 1.9 percent during the past five trading days as investors remain cautious as to whether or not the pending government shutdown will eventually harm USA economic growth. The current fall is now the longest witnessed on the index since Dec 28th 2012, when USA lawmakers clashed over the impending automatic spending cuts and tax increases known as the "fiscal cliff". Sterling advanced 0.4 percent to $1.6070 late in the London session after rising to $1.6163 on Sept 18th, which was the highest level seen since Jan 11th. The U.K. currency was little changed at 84.22 pence per euro after appreciating to 83.53 pence on Sept 18th, the strongest level seen since Jan 17th. Sterling strengthened towards its eight-month high versus the dollar after a gauge of U.K. retail sales from the UK's CBI increased in September, adding to signs the U.K. economy is improving, slowly. Sterling rose versus all of its 16 major counterparts before a report today that analysts believe will confirm that the U.K. economy expanded last quarter by the estimated 0.7%. The pound has in fact been the best performer during the past six months, appreciating 5.8 percent versus the dollar. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-09-26 08:30 GMT | UK Gross Domestic Product (YoY) (Q2) 2013-09-26 12:30 GMT | US Gross Domestic Product Annualized (Q2) 2013-09-26 14:00 GM | US Pending Home Sales (YoY) (Aug) 2013-09-26 23:30 GMT | JP National CPI Ex Food, Energy (YoY) (Aug) FOREX NEWS : 2013-09-26 05:37 GMT | USD/JPY surges as Nikkei cracks the 14,500 2013-09-26 05:36 GMT | EUR/USD gathering steam for another upside move ahead of European 2013-09-26 04:28 GMT | GBP/USD consolidating big gains from Wednesday; first support 1.6046 2013-09-26 03:17 GMT | GBP/JPY propelled to 159.27 highs ------------------- EURUSD HIGH 1.35306 LOW 1.35116 BID 1.35209 ASK 1.35213 CHANGE -0.03% TIME 08 : 47:50  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: An element of resistive measures could be found at 1.3538 (R1). Clearance here would suggest further uptrend development towards to our interim target at 1.3562 (R2). Final aim locates today at 1.3584 (R3). Downwards scenario: On the other side, depreciation below the support barrier at 1.3507 (S1) might provide sufficient space for the recovery action. In such case we would suggest next intraday targets at 1.3483 (S2) and then 1.3459 (S3). Resistance Levels: 1.3538, 1.3562, 1.3584 Support Levels: 1.3507, 1.3483, 1.3459 ---------------- GBPUSD HIGH 1.60865 LOW 1.60671 BID 1.60771 ASK 1.60775 CHANGE -0.01% TIME 08 : 47:51  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: On the upside, fractals level at 1.6090 (R1) offers an important resistive structure. Any penetration above that level would suggest next intraday targets at 1.6114 (R2) and 1.6137 (R3). Downwards scenario: On the other hand, our bearish expectations remain intact below the key support level at 1.6055 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6031 (S2) and 1.6006 (S3). Resistance Levels: 1.6090, 1.6114, 1.6137 Support Levels: 1.6055, 1.6031, 1.6006 ----------------- USDJPY HIGH 99.11 LOW 98.269 BID 98.893 ASK 98.896 CHANGE 0.47% TIME 08 : 47:52  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Market remains relatively stable above the moving averages. Clearance of next resistance level at 99.11 (R1) might initiates bullish pressure and expose our intraday targets at 99.26 (R2) and 99.42 (R3) later on today. Downwards scenario: Clearance of our support at 98.68 (S1) is required to determine negative intraday bias and enable lower target at 98.51 (S2) and then any further market depreciation would suggest final aim at 98.34 (S3). Resistance Levels: 99.11, 99.26, 99.42 Support Levels: 98.68, 98.51, 98.34 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Sep 27 2013

Forex Technical & Market Analysis FXCC Sep 27 2013

USA Congress still at odds over debt ceiling Despite the hope that the USA will eventually agree a new debt ceiling, U.S. Congress has failed to pass the necessary budget, Republicans and Democrats continue to disagree over whether to stop funding the 2010 health-care initiative known as Obamacare, thereby threatening a a government shutdown by Oct 1st. Equities rose in Thursday's trading sessions, with the Standard & Poor’s 500 Index rising by 0.4 percent to 1,698.67 at the close in the New York session. The yield on the 10-year Treasury note also climbed two basis points, or 0.02 percentage point, to 2.65 percent. Other data sets published on Thursday may have confirmed that the USA economy improved in the second quarter of 2013, however, positive GDP numbers were countered by fewer Americans signing contracts to buy previously owned homes in August. USA GDP rose at a 2.48% percent annual rate, unrevised from the previous estimate, after expanding 1.1 percent in the first quarter, the USA Commerce Department reported. The index of pending home sales fell 1.6 percent, the recent rise in mortgage rates slowing momentum in the housing market, according to figures from the National Association of Realtors. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-09-27 12:00 GMT | DE.Harmonised Index of Consumer Prices (YoY) (Sep)Preliminar 2013-09-27 12:00 GMT | DE.Consumer Price Index (MoM) (Sep)Preliminar 2013-09-27 12:30 GMT | US.Personal Spending (Aug) 2013-09-27 12:30 GMT | US.Personal Income (MoM) (Aug) FOREX NEWS : 2013-09-27 05:01 GMT | EUR/CHF at six-week low 2013-09-27 04:02 GMT | EUR/USD under pressure on Italian political uncertainty 2013-09-27 02:53 GMT | AUD/JPY dives to 92.13 bottoms 2013-09-27 02:37 GMT | EUR/JPY cracks down to 133.02 lows EURUSD : HIGH 1.3491 LOW 1.34742 BID 1.34868 ASK 1.34871 CHANGE -0.01% TIME 08 : 11:57  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Resistance level at 1.3504 (R1) acts as reference point for further market strengthening. Break here is required to enable next interim target at 1.3523 (R2) en route towards to final aim for today at 1.3542 (R3). Downwards scenario: Next challenge on the downside is seen at 1.3472 (S1). Breakthrough of this mark would open way for a downside expansion and could possibly trigger our initial targets at 1.3452 (S2) and 1.3435 (R3) later on today. Resistance Levels: 1.3504, 1.3523, 1.3542 Support Levels: 1.3472, 1.3452, 1.3435 GBPUSD : HIGH 1.60532 LOW 1.603 BID 1.60506 ASK 1.60511 CHANGE 0.06% TIME 08 : 11:57  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Our attention on the upside is put to the next resistive barrier at 1.6139 (R1). Break here is required to stimulate bullish forces to expose initial targets at 1.6170 (R2) and 1.6206 (R3) later on today. Downwards scenario: We do expect some pull-backs development on the downside below the support level at 1.6030 (S1). Short-term momentum on the negative side might open the way towards to immediate supports at 1.6000 (S2) and 1.5964 (S3). Resistance Levels: 1.6139. 1.6170, 1.6206 Support Levels: 1.6030, 1.6000, 1.5964 ----------------------- USDJPY : HIGH 99.04 LOW 98.624 BID 98.634 ASK 98.636 CHANGE -0.34% TIME 08 : 11:58  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Market remains sideways oriented. Next hurdle on the upside might be found at 99.05 (R1). Break here would open road towards to our interim aim at 99.33 (R2) and enable final intraday resistive measure at 99.58 (R3). Downwards scenario: On the other hand, our next support level aligns at 98.56 (S1) and possible price regress below it might encounter downside rally. In such scenario we would suggest next intraday targets to be placed at 98.25 (S2) and 97.97 (S3). Resistance Levels: 99.05, 99.33, 99.58 Support Levels: 98.56, 98.25, 97.97 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] [url]http://www.fxcc.com[/url] [/url] ) |

Forex Technical & Market Analysis FXCC Oct 01 2013

Forex Technical & Market Analysis FXCC Oct 01 2013

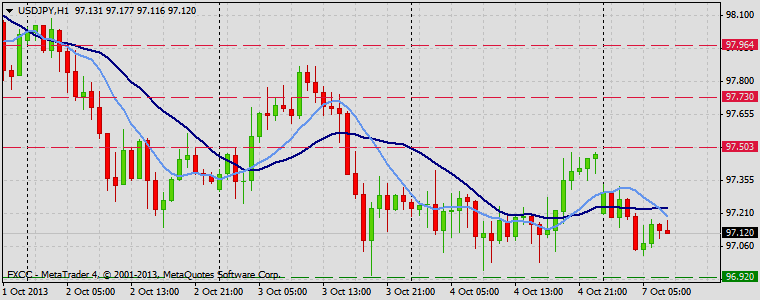

The US government shutdown - truth or dare Early in the overnight/early morning session we'll have received the RBA decision regarding the base rate for Australia, this will be accompanied by a statement concerning the decision, which is expected to keep the current rate at 2.5%. The U.S. government looks set for its first partial shutdown in over 17 years, with no signs of compromise from the Congress or the White House. The U.S. has had 17 funding gaps from 1977 to 1996. In 1995 and 1996, interruptions lasted from Nov 14th to Nov 19th and from Dec 16th to Jan 6th, as Republicans led by House Speaker Newt Gingrich clashed with President Bill Clinton. Equity index futures are down on the USA equity markets, the DJIA equity index future is down 0.98 at the time of writing, leaving the index at 15046, very close to the critical 15,000 level. SPX equity index future is down 0.62%. European equity index futures are mainly in the red, STOXX down 0.9%, FTSE down 0.79% and the DAX down 0.87%. The U.S. Dollar Index, tracking the performance of a basket of the 10 leading global currencies versus the dollar, fell for a second trading-day, declining by 0.1 percent to 1,011.85 late in the New York session, after weakening by as much as 0.2 percent. The yen was little changed at 98.30 per dollar after touching 97.50, the strongest level since Aug 29th. Japan’s currency fell 0.1 percent to 132.93 versus the euro after appreciating to 131.38, the strongest level witnessed since Sept 9th. The euro was little changed at $1.3527. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-01 09:00 GMT | EU.EMU Unemployment Rate (Aug) 2013-10-01 12:58 GMT | US. Markit Manufacturing PMI (Oct) 2013-10-01 14:00 GMT | US. Construction Spending (MoM) (Aug) 2013-10-01 14:00 GMT | US. ISM Manufacturing PMI (Sep) FOREX NEWS : 2013-10-01 05:18 GMT | AUD/JPY continues short-term upside following Aussie rate decision and comments 2013-10-01 04:39 GMT | EUR/USD eyes 1.3550 as shutdown kicks in 2013-10-01 04:31 GMT | USD/JPY slipping and sliding now that US government shutdown is a reality 2013-10-01 04:01 GMT | GBP/USD is spiking as the Senate votes down the House spending bill --------------------- EURUSD : HIGH 1.35519 LOW 1.35174 BID 1.35448 ASK 1.35452 CHANGE 0.14% TIME 08 : 24:34  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Next resistance level is seen at 1.3555 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.3578 (R2) and 1.3600 (R3) in potential. Downwards scenario: Possible pull back development is limited now to the key supportive barrier at 1.3517 (S1). Only loss here would be considered as a beginning of a retracement expansion. Our intraday targets locates at 1.3472 (S2) and 1.3435 (S3). Resistance Levels: 1.3555, 1.3578, 1.3600 Support Levels: 1.3517, 1.3472, 1.3435 -------------------- GBPUSD : HIGH 1.62465 LOW 1.61823 BID 1.62370 ASK 1.62374 CHANGE 0.32% TIME 08 : 24:35  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: The local peak at 1.6247 (R1) offers an important resistive level. Any penetration above it might shift the balance to the bullish side and validate our intraday targets at 1.6279 (R2) and 1.6308 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.6207 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.6180 (S2) and 1.6139 (S3). Resistance Levels: 1.6247, 1.6279, 1.6308 Support Levels: 1.6207, 1.6180, 1.6139 --------------------------- USDJPY : HIGH 98.728 LOW 98.031 BID 98.124 ASK 98.129 CHANGE -0.09% TIME 08 : 24:36  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Neutral IMPLIED VOLATILITY : Medium Upwards scenario: Break above the next resistance level at 98.56 (R1) is required to generate upside action and trigger our intraday targets at 98.81 (R2) and 99.05 (R3). Downwards scenario: Further correction development is limited now to the session low - 97.95 (S1). If the price manages to surpass it we would suggest next intraday targets at 97.63 (S2) and 97.30 (S3). Resistance Levels: 98.56, 98.81, 99.05 Support Levels: 97.95, 97.63, 97.30 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 02 2013

Forex Technical & Market Analysis FXCC Oct 02 2013

Ben Bernanke may delay taper if shut down impasse continues The Swiss franc appears to have become the safe haven currency of choice during the USA partial govt. shutdown. The Swiss franc rose to its highest level versus the dollar in nineteen months as a partial shutdown of the U.S. government increased demand for Switzerland’s currency as a safe haven currency. The franc is typically sought by investors seeking safety at times of heightened global stress and it climbed versus all but two of its 16 major currency peers during Tuesday's trading sessions. Versus the USD it strengthened through 90 cents per dollar for the first time since Feb. 29, 2012. The Swiss currency rose 0.3 percent to 90.23 centimes per dollar at 10:50 a.m. in Zurich, after rising to as much as 89.93 centimes. Versus the euro it was little changed at 1.2225. The dollar traded at close to its lowest level seen since February as the partial shutdown of the U.S. government increased speculation that the Federal Reserve will persevere with its asset purchases, therefore weakening the currency. The U.S. currency was little changed at $1.3526 per euro after depreciating to $1.3588, the weakest level seen since Feb 6th. The yen gained by 0.3 percent to 98 per dollar and climbed 0.3 percent to 132.55 per euro. FOREX ECONOMIC CALENDAR : 2013-10-02 11:45 GMT | ECB Interest Rate Decision 2013-10-02 12:30 GMT | ECB Monetary policy statement and press conference 2013-10-02 19:30 GMT | US Fed's Bernanke Speech 2013-10-02 23:50 GMT | JP Foreign investment in Japan stocks FOREX NEWS : 2013-10-02 04:48 GMT | EUR/USD sitting on the fence ahead of ECB 2013-10-02 04:11 GMT | GBP/AUD soars on dismal AUD data 2013-10-02 03:46 GMT | RBA next rate cut delayed till February - NAB 2013-10-02 03:12 GMT | Japan’s the black sheep among winning indexes in Asia EURUSD : HIGH 1.35282 LOW 1.35074 BID 1.35240 ASK 1.35244 CHANGE -0.01% TIME 08 : 32:56  OUTLOOK SUMMARY : Neutral TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: Fractals level at 1.3536 (R1) offers a key resistive measure on the upside. Break here is required to enable bullish pressure and validate next target at 1.3551 (R2). Final support for today locates at 1.3566 (R3). Downwards scenario: As long as price stays below the next resistance level our technical outlook would be negative. Next on tap is support level at 1.3506 (S1). Penetration below this mark would suggest next targets at 1.3491 (S2) and 1.3475 (S3). Resistance Levels: 1.3536, 1.3551, 1.3566 Support Levels: 1.3506, 1.3491, 1.3475 ---------------------------- GBPUSD : HIGH 1.62001 LOW 1.61625 BID 1.61790 ASK 1.61795 CHANGE -0.1% TIME 08 : 32:57  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: Possible upwards extension above the resistance level at 1.6210 (R1) is liable to commence medium-term bullish structure. Important fractal levels offers next targets at 1.6238 (R2) and 1.6265 (R3) in potential. Downwards scenario: Risk of further correction expansion is seen below the support barrier at 1.6158 (S1). Break here is required to enable our intraday targets at 1.6130 (S2) and 1.6103 (S3) on the downside. Resistance Levels: 1.6210, 1.6238, 1.6265 Support Levels: 1.6158, 1.6130, 1.6103 ---------------------- USDJPY : HIGH 98.085 LOW 97.639 BID 97.648 ASK 97.651 CHANGE -0.37% TIME 08 : 32:57  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : High Upwards scenario: Fresh portion of the economic data releases might increase volatility later on today. Clearance of our next resistive barrier at 98.09 (R1) is required to push the price towards to our next visible targets at 98.33 (R2) and 98.56 (R3). Downwards scenario: As long as price stays below the moving averages our short-term outlook would be negative. Possible extension lower the 97.50 (S1) is being able to drive market price towards to initial supports at 97.25 (S2) and 97.01 (S3). Resistance Levels: 98.09, 98.33, 98.56 Support Levels: 97.50, 97.25, 97.01 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 03 2013

Forex Technical & Market Analysis FXCC Oct 03 2013

EUR/USD explodes to 1.3624, 8-month peaks The European Central Bank President Mario Draghi stated on Wednesday that he’ll take any necessary measures to keep the money-market rates in check as he guides Europe’s banks through their early stages of the economic recovery. Draghi stated; “We’ll remain particularly attentive to developments which may have implications to monetary policy and consider all available instruments. We have a vast array of instruments to this extent and we exclude no option in order to address the needs as is most appropriate.” The euro advanced 0.4 percent to $1.3586 late in the New York session, reaching the biggest one-day gain since Sept 18th. The 17 nation shared single currency was 0.2 percent weaker at 132.28 yen after falling as much as 0.9 percent. The yen strengthened 0.6 percent to 97.39 per dollar. The euro strengthened the most in two weeks versus the dollar after European Central Bank President Mario Draghi refrained from signaling that additional measures were needed to boost the region’s recovery. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-03 07:53 GMT | DE Markit Services PMI (Sep) 2013-10-03 07:58 GMT | EMU Markit Services PMI (Sep) 2013-10-03 09:00 GMT | EMU Retail Sales (YoY) (Aug) N/A | US Initial Jobless Claims (Sep 27) FOREX NEWS : 2013-10-03 05:36 GMT | EUR/GBP slightly upwards ahead of crucial UK,EZ data 2013-10-03 05:06 GMT | GBP/USD sits on the fence ahead of UK PMI Services data 2013-10-03 02:16 GMT | EUR/USD triggers stops 1.36+, JPY on the slide 2013-10-03 02:00 GMT | USD/JPY retracing from 97.70 session highs ----------------- EURUSD : HIGH 1.36232 LOW 1.35775 BID 1.36065 ASK 1.36069 CHANGE 0.22% TIME 08 : 39:59  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Current price setup might suggest uptrend development in near term perspective. If the price manages to surpass our resistive measure at 1.3623 (R1), we would suggest next targets at 1.3644 (R2) and 1.3665 (R3). Downwards scenario: On the other side, a dip lower the key support measure at 1.3575 (S1) would open a route towards to lower targets at 1.3555 (S2) and 1.3535 (S3). Resistance Levels: 1.3623, 1.3644, 1.3665 Support Levels: 1.3575, 1.3555, 1.3535 ------------------ GBPUSD : HIGH 1.62409 LOW 1.62206 BID 1.62329 ASK 1.62335 CHANGE 0.07% TIME 08 : 39:59  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: A bullish oriented market participant might pressures to test our next resistance level at 1.6261 (R1). Loss here could open a route towards to our interim target at 1.6292 (R2) and the main aim for today locates at 1.6323 (R3). Downwards scenario: Risk of possible price regress is seen below the support level at 1.6202 (S1). Break here would suggest lower targets at 1.6170 (S2) and 1.6139 (S3) in potential. Resistance Levels: 1.6261, 1.6292, 1.6323 Support Levels: 1.6202, 1.6170, 1.6139 ------------------------- USDJPY : HIGH 97.784 LOW 97.251 BID 97.700 ASK 97.702 CHANGE 0.36% TIME 08 : 40:00  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Market commenced recovery phase from the initial downtrend formation. Clearance of our next resistive barrier at 98.05 (R1) would suggest next intraday targets at 98.32 (R2) and 98.59 (R3) in potential. Downwards scenario: Further downside extension might face next supportive barrier at 97.53 (S1). Clearance here is required to open the way towards to interim target at 97.25 (S2) and any further price regress would then be targeting 96.98 (S3). Resistance Levels: 98.05, 98.32, 98.59 Support Levels: 97.53, 97.25, 96.98 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 04 2013

Forex Technical & Market Analysis FXCC Oct 04 2013

US interest rates could skyrocket Due to the govt. shutdown there will be no NFP number printed by the BLS on Friday. Two FOMC members hold court in the afternoon session, once again, despite the turmoil in govt. due to the shutdown, investors will be looking for clues with regards to potential tapering of the Fed's $85 billion per month asset purchase scheme. The US Treasury warned on Thursday that the budget impasse between the Republicans and Democrats in Washington risked plunging the world's biggest economy into its worst slump since the Great Depression; "A default would be unprecedented and has the potential to be catastrophic. Credit markets could freeze, the value of the dollar could plummet, US interest rates could skyrocket, the negative spillovers could reverberate around the world, and there might be a financial crisis and recession that could echo the events of 2008 or worse." [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2011-08-10 06:00 GMT | DE Producer Price Index (MoM) (Aug) 2011-08-10 09:00 GMT | EMU Producer Price Index (YoY) (Aug) 2011-08-10 14:00 GMT | CA Ivey Purchasing Managers Index (Sep) 2011-08-10 17:45 GMT | US Fed Minneapolis's Narayana Kocherlakota speech FOREX NEWS : 2013-10-04 05:49 GMT | Asian bourses closing on the down side 2013-10-04 04:19 GMT | EUR/GBP sails its way down to 0.8423 session lows 2013-10-04 04:06 GMT | AUD/USD remains resilient amidst a poor risk-off environment 2013-10-04 03:35 GMT | EUR/USD losing momentum? Gains wiped out ----------------- EURUSD HIGH 1.36317 LOW 1.36183 BID 1.36259 ASK 1.36263 CHANGE 0.05% TIME 08 : 40:02  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: On the upside EURUSD is limited to the next resistive barrier at 1.3646 (R1). If the price manages to surpass this mark we would suggest next intraday targets at 1.3668 (R2) and 1.3690 (R3). Downwards scenario: Our next support level is placed at important technical level- 1.3607 (S1). Clearance here might stimulate bearish market participants to drive market price towards to our initial targets at 1.3584 (S2) and 1.3561 (S3) in potential. Resistance Levels: 1.3646, 1.3668, 1.3690 Support Levels: 1.3607, 1.3584, 1.3561 --------------------- GBPUSD : HIGH 1.61779 LOW 1.61532 BID 1.61721 ASK 1.61726 CHANGE 0.1% TIME 08:40:03  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: On the upside potential is seen for a break above the resistance at 1.6187 (R1). In such case we would suggest next target at 1.6215 (R2) and any further rise would then be limited to final resistance at 1.6241 (R3). Downwards scenario: Medium term bias is clearly positive however we expect recovery action if the price manages to overcome key supportive bastion at 1.6150 (S1). In such case we would suggest next intraday targets at 1.6125 (S2) and 1.6099 (S3). Resistance Levels: 1.6187, 1.6215, 1.6241 Support Levels: 1.6150, 1.6125, 1.6099 ------------------ USDJPY : HIGH 97.403 LOW 97.034 BID 97.111 ASK 97.113 CHANGE -0.15% TIME 08 : 40:04  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Mark at 97.50 (R1) acts as next resistive barrier on the way if the pair commence recovery phase. Break here is required to achieve higher targets at 97.80 (R2) and 98.10 (R3) later on today. Downwards scenario: In terms of technical levels, risk of price depreciation is seen below the support level at 96.92 (S1). Loss here would suggest to monitor marks at 96.62 (S2) and 96.33 (S3) as possible intraday targets. Resistance Levels: 97.50, 97.80, 98.10 Support Levels: 96.92, 96.62, 96.33 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 07 2013

Forex Technical & Market Analysis FXCC Oct 07 2013

Yen rises versus major peers early in the Asian session There were no significant breaks or gaps to the upside or downside as the FX markets opened on Sunday evening. Yen made a modest rise versus the majority of its peers, but at the time of writing had failed to penetrate the significant resistance or support levels. The dollar fell for a fifth week last week, the longest stretch the greenback has experienced such a fall since April 2011, due to Congress failing to agree on a route forward to raise the $16.7 trillion U.S. debt limit, encouraging investors to seek other safe haven assets. The U.S. Dollar Index, tracking the greenback versus its 10 major peer currencies, declined by 0.3 percent last week, (the most in two weeks), to 1,009.98 in New York at the close on Friday. The dollar fell 0.8 percent to 97.48 yen, the third weekly drop. It touched 96.93, the lowest since Aug. 28th. The U.S. currency weakened by 0.3 percent to $1.3558 per euro. The yen strengthened 0.5 percent to 132.14 per euro. Sterling fell by the most last week in the dollar’s 16 most-traded peers, after reaching a nine-month high, the sell off was due to speculation that the U.K. economic recovery isn’t strong enough to warrant the early interest-rate increase the BoE governor Mark Carney had mentioned in earlier press conferences. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-07 08:30 GMT | EMU Sentix Investor Confidence (Oct) 2013-10-07 12:30 GMT | CA Building Permits (MoM) (Aug) 2013-10-07 19:00 GMT | US Consumer Credit Change (Aug) 2013-10-07 23:50 GMT | Trade Balance - BOP Basis (Aug) FOREX NEWS : 2013-10-07 05:18 GMT | Asian bourses fall sharply due to US political “jitters” 2013-10-07 04:49 GMT | AUD/USD trading in the upper level ignoring US political “woes” 2013-10-07 03:49 GMT | USD a tad weaker as US shutdown set to extend 2013-10-07 02:37 GMT | EURUSD - Uptrend intact but latest pullbacks raises some concerns - 2ndSkies ---------------- EURUSD : HIGH 1.35742 LOW 1.35609 BID 1.35680 ASK 1.35685 CHANGE 0.09% TIME 08 : 45:02  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Next barrier on the upside lies at 1.3579 (R1). Surpassing of this level might enable our initial target at 1.3594 (R2) and any further gains would then be limited to last resistive structure at 1.3609 (R3). Downwards scenario: Positive clearance of our key support level at 1.3538 (S1) would enable next target at 1.3523 (S2) en route to our final support for today at 1.3508 (S3). Resistance Levels: 1.3579, 1.3594, 1.3609 Support Levels: 1.3538, 1.3523, 1.3508 ---------------------- GBPUSD : HIGH 1.60483 LOW 1.60153 BID 1.60325 ASK 1.60329 CHANGE 0.17% TIME 08 : 45:03  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Our next resistance level is placed at 1.6050 (R1). Break here would open route towards to higher target at 1.6068 (R2) and any further price advance would then be limited to 1.6086 (R3). Downwards scenario: Failure to establish corrective structure might lead to further downtrend evolvement later on today. Penetration below the support at 1.6005 (S1) would suggest next intraday targets at 1.5987 (S2) and 1.5970 (S3) in perspective. Resistance Levels: 1.6050, 1.6068, 1.6086 Support Levels: 1.6005, 1.5987, 1.5970 -------------------- USDJPY : HIGH 97.338 LOW 97.021 BID 97.144 ASK 97.148 CHANGE -0.34% TIME 08 : 45:04  OUTLOOK SUMMARY : Neutral TREND CONDITION : Sideway TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Price is consolidating on the hourly timeframe however we see potential to overcome our next resistance level at 97.50 (R1) later on today. Our initial targets locates at 97.73 (R2) and 97.96 (R3). Downwards scenario: On the other hand, prolonged movement below the supportive measure at 96.92 (S1) is required to activate new phase of downtrend expansion. We would suggest next aim at 96.68 (S2) and then final target could be met at 96.45 (S3). Resistance Levels: 97.50, 97.73, 97.96 Support Levels: 96.92, 96.68, 96.45 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 08 2013

Forex Technical & Market Analysis FXCC Oct 08 2013

Chinese government officials fire off warning to USA treasury The DJIA closed down 0.90% having experienced a late sell off towards the close of the afternoon session on Monday. As the day unwound any optimism for a solution faded, as did the secular rally enjoyed mid afternoon in the New York session. The SPX followed suit, closing down 0.85% and the NASDAQ closed down 0.98%. In the Chinese government's first public comments on the deadlock, Zhu urged Washington politicians to "learn their lessons from history". A reminder that the US AAA credit rating was downgraded by S&P two years ago after the last debt ceiling standoff. Zhu said; "The United States is totally clear about China's concerns about the fiscal cliff. We ask that the United States earnestly takes steps to resolve in a timely way before October 17 the political [issues] around the debt ceiling and prevent a U.S. debt default to ensure safety of Chinese investments in the United States and the global economic recovery. This is the United States' responsibility." [url]http://blog.fxcc.com/market-analysis[/url] 2013-10-08 12:15 GMT | Canada. Housing Starts s.a (YoY) (Sep) 2013-10-08 16:00 GMT | Switzerland. SNB Chairman Jordan Speech 2013-10-08 23:30 GMT | Australia. Westpac Consumer Confidence (Oct) 2013-10-08 23:50 GMT | Japan. BoJ Monetary Policy Meeting Minutes FOREX NEWS : 2013-10-08 05:00 GMT | USD/JPY pares earlier losses and strikes back above 97.00 2013-10-08 04:06 GMT | GBP/USD slightly downwards but consolidating yesterday’s gains 2013-10-08 03:28 GMT | USD/CHF pockets gains printing 0.9044 session highs 2013-10-08 01:56 GMT | EUR/USD glued to 1.3568 support ------------------------- EURUSD : HIGH 1.35816 LOW 1.35574 BID 1.35616 ASK 1.35618 CHANGE -0.14% TIME 08 : 13:56  OUTLOOK SUMMARY : TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Our technical outlook for the medium-term perspective remains bullish oriented. Clearance of next resistance level at 1.3583 (R1) would enable bullish pressure and open route towards to our next targets at 1.3607 (R2) and 1.3630 (R3). Downwards scenario: Medium-term bias is clearly positive however possible progress below the initial support level at 1.3560 (S1) might expose our intraday targets at 1.3542 (S2) and then 1.3517 (S3) in perspective. Resistance Levels: 1.3583, 1.3607, 1.3630 Support Levels: 1.3560, 1.3542, 1.3517 ---------------- GBPUSD : HIGH 1.60988 LOW 1.60695 BID 1.60699 ASK 1.60703 CHANGE -0.16% TIME 08 : 13:57  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Possible upwards formation is limited now to resistive measure at 1.6099 (R1). A break above it would suggest next intraday target at 1.6122 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 1.6150 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.6061 (S1), we expect to see further market decline towards to our next target at 1.6035 (S2) and then next stop could be found at 1.6008 (S3) mark. Resistance Levels: 1.6099, 1.6122, 1.6150 Support Levels: 1.6061, 1.6035, 1.6008 ------------------- USDJPY : HIGH 97.134 LOW 96.566 BID 97.056 ASK 97.059 CHANGE 0.36% TIME 08 : 13:58  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Immediate resistance at 97.29 (R1) remains in near-term focus, climb above this level might open way for a stronger move towards to next interim target at 97.58 (R2) and any further rise would then be limited to final resistive measure at 97.87 (R3). Downwards scenario: On the other hand, our next support level aligns at 96.79 (S1) and possible price regress below it might encounter downside rally. In such scenario we would suggest next intraday targets to be placed at 96.43 (S2) and 96.05 (S3). Resistance Levels: 97.29, 97.58, 97.87 Support Levels: 96.79, 96.43, 96.05 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 09 2013

Forex Technical & Market Analysis FXCC Oct 09 2013

IMF lowers global growth targets as USA debt ceiling impasse drags on The IMF now expects the global economy to expand by 2.9% in 2013 and 3.6% in 2014, down by 0.3 and 0.2 points respectively on its last predictions, made in July, despite signs of recovery in the euro area. Obama's late statement on Tuesday evening spooked the USA indices, at the start of his speech the DJIA was hovering around a 0.7% loss on the day, by the time he'd finished and the markets had closed the DJIA was down 1.07%, the SPX closed down 1.23% and the NASDAQ down a precise 2.00% on the day. Equity index futures are, at the time of writing, pointing to another negative day on both the European and USA markets. The DJIA equity index future is down 0.92%, SPX down 1.06%, NASDAQ down 1.69%. UK FTSE equity index future is down 0.91%, CAC down 0.73% and the DAX equity index future is down 0.24% The dollar increased 0.2 percent to 96.88 yen late in New York on Tuesday after gaining as much as 0.6 percent earlier in the day. The greenback was little changed at $1.3573 per euro after rising 0.2 percent earlier. The 17-nation shared common currency appreciated by 0.1 percent to 131.49 yen. The dollar rose versus 13 of its 16 most-traded peers as the U.S. political stalemate persisted and President Barack Obama warned the nation faces a “very deep recession” if Congress doesn’t raise the debt limit, fueling safe haven demand for the dollar. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-09 08:30 GMT | UK Industrial Production (YoY) (Aug) 2013-10-09 14:00 GMT | UK NIESR GDP Estimate (3M) (Sep) 2013-10-09 18:00 GMT | US FOMC Minutes 2013-10-09 22:00 GMT | ECB President Draghi's Speech FOREX NEWS : 2013-10-09 03:36 GMT | GBP/USD rally fizzles early Tuesday likely on “fade the news” reaction to Yellen news 2013-10-09 03:22 GMT | EUR/USD violates support printing 1.3562 session lows 2013-10-09 02:53 GMT | AUD/USD tumbling after poor Aussie data 2013-10-09 02:26 GMT | USD/JPY spikes to 97.36 peaks on +43 pips gains ---------------------- EURUSD HIGH 1.36046 LOW 1.35617 BID 1.35630 ASK 1.35633 CHANGE -0.08% TIME 08 : 42:32  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: EURUSD tested negative territory today though appreciation above the resistive structure at 1.3584 (R1) might shift short-term tendency to the bullish side and validate our intraday targets at 1.3596 (R2) and 1.3607 (R3). Downwards scenario: Market decline below the support level at 1.3557 (S1) might shift market sentiment to the bearish side. In such scenario we expect next targets to be exposed today at 1.3546 (S2) and 1.3535 (S3). Resistance Levels: 1.3584, 1.3596, 1.3607 Support Levels: 1.3557, 1.3546, 1.3535 ------------------------ GBPUSD HIGH 1.61219 LOW 1.60612 BID 1.60664 ASK 1.60672 CHANGE -0.1% TIME 08 : 42:33  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: From the technical side, medium - term tendency is bearish, however new step of recovery phase is possible above the resistance level at 1.6086 (R1). Loss here would open way towards to next targets at 1.6106 (R2) and 1.6127 (R3). Downwards scenario: Our next support level is placed at 1.6058 (S1). Possible penetration below it might initiate bearish pressure and gradually push the price towards to our intraday targets at 1.6039 (S2) and 1.6019 (S3). Resistance Levels: 1.6086, 1.6106, 1.6127 Support Levels: 1.6058, 1.6039, 1.6019 -------------------- USDJPY : HIGH 97.446 LOW 96.825 BID 97.404 ASK 97.408 CHANGE 0.56% TIME 08 : 42:34  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: USDJPY trapped to the correction phase on the hourly chart frame. Break of resistive level at 97.48 (R1) is required to enable upwards action. Next visible targets are seen at 97.67 (R2) and 97.85 (R3). Downwards scenario: Though, we still keep the bearish scenario in focus. Risk of market decline is seen below the support level at 97.18 (S1). Loss here would enable initial targets at 97.00 (S2) and 96.80 (S3). Resistance Levels: 97.48, 97.67, 97.85 Support Levels: 97.18, 97.00, 96.80 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 10 2013

Forex Technical & Market Analysis FXCC Oct 10 2013

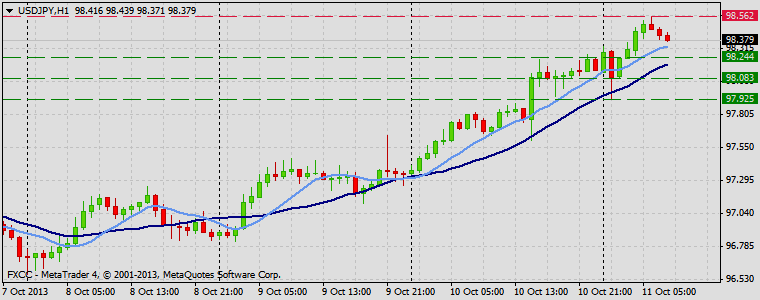

Yellen's hard task highlighted by the minutes from the FOMC Janet Yellen's difficult task was highlighted by the FOMC minutes published on Wednesday. Policy makers at the US Federal Reserve were split over the benefits of slowing down (tapering) its $85bn a month asset purchases in September, highlighting the difficult task facing her as she prepares to take chairmanship of the central bank. Barack Obama stepped up his discussions with Congress as USA political leaders look for a solution to the budget crisis that could leave the country without money to pay its bills before the end of the month. The president will meet senior Republicans from the House of Representatives at the White House on Thursday, after talks with members of his Democratic party on Wednesday evening. US default swaps trade has soared on debt fears. Growing investor fears that Washington could miss a payment on its debt has led to a surge in activity in the market for derivatives that insure against a US default. Commodities were hit hard in Wednesday's trading sessions; ICE WTI oil closing down 2.05% at $101.37 per barrel, NYMEX natural down 1.00% at $3.68 per therm. COMEX gold closed the day down 1.31%, silver down 2.46% at $21.89 per ounce. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-10 08:00 GMT | ECB Monthly Report 2013-10-10 11:00 GMT | BoE Interest Rate Decision 2013-10-10 11:45 GMT | Bank of Japan Governor Kuroda Speech 2013-10-10 16:00 GMT | Bank of Japan Governor Kuroda Speech FOREX NEWS : 2013-10-10 05:43 GMT | USD/CHF on a strong rally higher 2013-10-10 04:32 GMT | USD/JPY soars on Nikkei, solid data and short-covering 2013-10-10 04:30 GMT | EUR/USD working on a re-test of yesterday’s low at 1.3488 2013-10-10 03:17 GMT | GBP/USD struggling to set a solid short-term low; anywhere in 1.5841 – 1.5908 will do EURUSD : HIGH 1.35275 LOW 1.34876 BID 1.35034 ASK 1.35037 CHANGE -0.13% TIME 08 : 52:42  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: We see potential to test our resistive barrier at 1.3516 (R1) later on today. Successful penetration above this mark might keep bullish sentiment in play and validate our intraday targets at 1.3531 (R2) and 1.3546 (R3). Downwards scenario: On the other hand, instrument might enable bearish pressure below the support level at 1.3485 (S1) and prolong initial downtrend development. Next targets on the way locates at 1.3471 (S2) and 1.3457 (S3). Resistance Levels: 1.3516, 1.3531, 1.3546 Support Levels: 1.3485, 1.3471, 1.3457 ------------------ GBPUSD : HIGH 1.59654 LOW 1.59142 BID 1.59405 ASK 1.59413 CHANGE -0.09% TIME 08 : 52:43  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : High Upwards scenario: Fractal level offers a key resistive barrier at 1.5968 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.6006 (R2) and 1.6039 (R3) in potential. Downwards scenario: Fresh low offers a key supportive measure at 1.5914 (S1) on a downside. A violation here is liable to commence correction pattern on the bigger picture and expose our initial targets at 1.5878 (S2) and 1.5845 (S3). Resistance Levels: 1.5968, 1.6006, 1.6039 Support Levels: 1.5914, 1.5878, 1.5845 -------------- USDJPY : HIGH 97.823 LOW 97.338 BID 97.727 ASK 97.731 CHANGE 0.39% TIME 08 : 52:44  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : High Upwards scenario: While price is quoted above the 20 SMA, our technical outlook would be positive. Clearance of our next resistance level at 97.87 (R1) would suggest next intraday targets at 98.01 (R2) and 98.14 (S3) in perspective. Downwards scenario: On the other hand, depreciation below the support level at 97.65 (S1) would suggest next intraday target at 97.51 (S2) and any further weakening would then be limited to final support level at 97.37 (S3). Resistance Levels: 97.87, 98.01, 98.14 Support Levels: 97.65, 97.51, 97.37 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 11 2013

Forex Technical & Market Analysis FXCC Oct 11 2013

ECB Agrees on swap line with PBOC as Chinese trade increases The European Central Bank and the People’s Bank of China agreed to establish a bilateral currency swap line on Thursday, increasing access to trade finance in the euro area and strengthening the international use of the yuan. The swap line will be valid for three years and have a maximum size of 350 billion yuan ($57 billion) when Chinese currency is provided to the ECB and 45 billion euros ($61 billion) when money is given to the PBOC. The arrangement is available to all Eurosystem counter-parties via national central banks, it said. House Speaker John Boehner has proposed extending the federal debt limit until Nov. 22nd as a way to shift debate back to a government-spending bill. The bill wouldn’t end the partial shutdown of the government, which began Oct. 1st after Republicans insisted on changes to the 2010 health-care law. Boehner told reporters the House wants to “offer the president today the ability to move.” [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 24h | G20 Finance Ministers and Central Bank Governors Meeting 24h | IMF Meeting 2013-10-11 06:00 GMT | DE Harmonised Index of Consumer Prices (YoY) (Sep) 2013-10-11 12:30 GMT | CA Unemployment Rate (Sep) FOREX NEWS : 2013-10-11 05:26 GMT | USD/CHF struggles to keep the 0.9100 level 2013-10-11 04:56 GMT | USD/CAD sits on the fence ahead of Canadian labor data, BoC outlook 2013-10-11 04:24 GMT | AUD/USD upwards amidst easing worries on US fiscal issues 2013-10-11 03:01 GMT | EUR/USD on steady climb to 1.3540 ------------------------ EURUSD : HIGH 1.35441 LOW 1.35178 BID 1.35347 ASK 1.35350 CHANGE 0.11% TIME 08 : 37:18  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: On the upside current structure might face next hurdle at 1.3546 (R1). Successful penetration above that mark would suggest next target zone – 1.3559 (R2) onto 1.3573 (R3) price levels. Downwards scenario: Any downside fluctuations remains for now limited to the next support barrier at 1.3517 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.3503 (S2) and 1.3489 (S3) in potential Resistance Levels: 1.3546, 1.3559, 1.3573 Support Levels: 1.3517, 1.3503, 1.3489 ------------------ GBPUSD : HIGH 1.59903 LOW 1.5963 BID 1.59881 ASK 1.59885 CHANGE 0.13% TIME 08 : 37:18  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Our next resistance level is placed at 1.5993 (R1). Clearance here is required to commence ascending structure towards to next target at 1.6023 (R2) and any further price appreciation would then be limited to 1.6053 (R3) mark. Downwards scenario: On the other side, a dip below the initial support level at 1.5950 (S1) is liable to trigger bearish pressure and drive market price towards to supportive means at 1.5921 (S2) and 1.5891 (S3) in potential. Resistance Levels: 1.5993, 1.6023, 1.6053 Support Levels: 1.5950, 1.5921, 1.5891 -------------------- USDJPY : HIGH 98.552 LOW 97.921 BID 98.370 ASK 98.373 CHANGE 0.23% TIME 08 : 37:19  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: USDJPY resumed upwards penetration today and we see potential to expose our intraday targets at 98.72 (R2) and 98.88 (R3) if the price manages to overcome key resistance measure at 98.56 (R1). Downwards scenario: Possible downside pressure could be maintained if the price penetrates below the support measure at 98.24 (S1). Clearance here would open way for a price move towards to lower targets at 98.08 (S2) and 97.92 (S3). Resistance Levels: 98.56, 98.72, 98.88 Support Levels: 98.24, 98.08, 97.92 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC Oct 14 2013

Forex Technical & Market Analysis FXCC Oct 14 2013

World Bank head Jim Yong Kim warns US is ‘five days away from a very dangerous moment Jim Yong Kim has warned the United States they're just 'days away' from causing a global economic disaster unless politicians come up with a plan to raise the nation's debt limit and avoid default. 'We're now five days away from a very dangerous moment. I urge U.S. policymakers to quickly come to a resolution before they reach the debt ceiling deadline. Inaction could result in interest rates rising, confidence falling and growth slowing. If this comes to pass, it could be a disastrous event for the developing world, and that will in turn greatly hurt developed economies as well." Meanwhile the Chinese have lost very little time in making their opinion known, one of the official news outlets, Xinhua, has begun to call for a new global reserve currency to be created given the instability of the dollar; "US fiscal failure warrants a de-Americanized world and the creation of a new reserve currency to be created to replace the dominant U.S. dollar, so that the international community could permanently stay away from the spillover of the intensifying domestic political turmoil in the United States." The U.S. shouldn’t risk defaulting on its debt because doing so would wreak havoc in the world’s economy and financial markets, said the heads of JPMorgan, Deutsche Bank AG and Pacific Investment Management Co. JPMorgan Chief Executive Officer Jamie Dimon said yesterday during a panel discussion at a financial industry conference in Washington; “The United States cannot default and, in my opinion, will not default. It would ripple through the global economy in a way you couldn’t possibly understand.” [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-14 24 hours | Eurogroup meeting 2013-10-14 24 hours | US. Columbus Day 2013-10-14 09:00 GMT | EU. Industrial Production s.a. (MoM) (Aug) 2013-10-14 12:00 GMT | Poland. M3 Money Supply (YoY) (Sep) FOREX NEWS : 2013-10-14 05:08 GMT | AUD/USD gains again uptrend momentum after solid China CPI release 2013-10-14 05:07 GMT | GBP/USD trading modestly higher on concerns over US politics 2013-10-14 04:20 GMT | USD/JPY under pressure on concerns about US debt ceiling 2013-10-14 04:20 GMT | GBP/JPY consolidating recent gains; technicians say a bit more upside likely ----------------------- EURUSD : HIGH 1.35668 LOW 1.35509 BID 1.35665 ASK 1.35668 CHANGE 0.18% TIME 08 : 25:37  OUTLOOK SUMMARY : Up TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Low MARKET ANALYSIS - Intraday Analysis Upwards scenario: We are not expecting significant volatility increase today however upside risk aversion is seen above the next resistance level at 1.3581 (R1). Price evaluation above this level would suggest next targets at 1.3599 (R2) and 1.3616 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.3551 (S1), we expect to see further market decline towards to our next target at 1.3536 (S2) and then next stop could be found at 1.3517 (S3) mark. Resistance Levels: 1.3581, 1.3599, 1.3616 Support Levels: 1.3551, 1.3536, 1.3517 ---------------------- GBPUSD : HIGH 1.59888 LOW 1.59633 BID 1.59859 ASK 1.59867 CHANGE 0.23% TIME 08 : 25:43  OUTLOOK SUMMARY : Up TREND CONDITION : Down trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Low Upwards scenario: On the upside market might get more incentives above the immediate resistive barrier at 1.6003 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.6035 (R2) and 1.6061 (R3). Downwards scenario: Penetration below the support at 1.5964 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 1.5928 (S2) and 1.5893 (S3) might be triggered. Resistance Levels: 1.6003, 1.6035, 1.6061 Support Levels: 1.5964, 1.5928, 1.5893 ------------------ USDJPY : HIGH 98.351 LOW 98.119 BID 98.258 ASK 98.262 CHANGE -0.31% TIME 08 : 25:51  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Low Upwards scenario: Any upside actions looks limited to resistance level at 98.60 (R1). Surpassing of this level might enable next target at 98.81 (R2) and any further gains would then be targeting final mark at 99.03 (R3) in potential. Downwards scenario: Next support level is seen at 98.10 (S1), any penetration below it might activate downside pressure and enable lower target at 97.89 (S2). Any further market decline would then be limited to 97.62 (S3). Resistance Levels: 98.60, 98.81, 99.03 Support Levels: 98.10, 97.89, 97.62 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

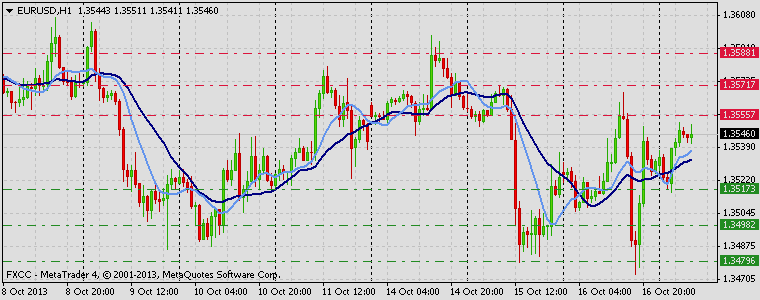

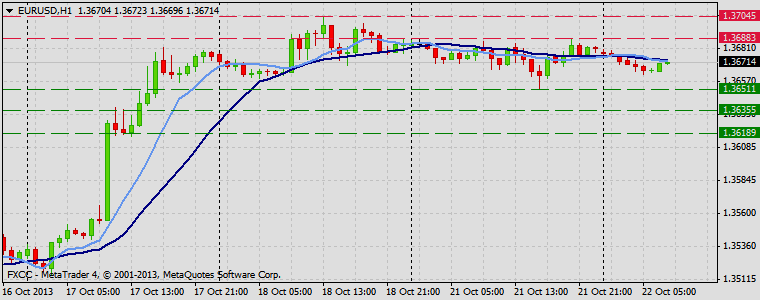

Forex Technical & Market Analysis FXCC Oct 17 2013

Forex Technical & Market Analysis FXCC Oct 17 2013

Debt ceiling temporary solution provides temporary market relief The debt ceiling resolution saw the DJIA rise by 1.36% on Wednesday. The compromise will fund the government through to mid-January and raise the debt ceiling through Feb. 7th. It also will set up a budget conference on long-term fiscal issues that would end no later than Dec. 13th. The Treasury Department will still be able to use "extraordinary measures" to work around the debt ceiling in the case that it is not raised by Feb. 7th. The first estimate for the euro area1 (EA17) trade in goods balance with the rest of the world in August 2013 gave a 7.1 billion euro surplus, compared with +4.6 bn in August 2012. The July 20132 balance was +18.0 bn, compared with +13.8 bn in July 2012. In August 2013 compared with July 2013, seasonally adjusted exports rose by 1.0% and imports by 0.2%. Euro area annual inflation was 1.1% in September 2013, down from 1.3% in August. A year earlier the rate was 2.6%. Monthly inflation was 0.5% in September 2013. European Union annual inflation was 1.3% in September 2013, down from 1.5% in August. A year earlier the rate was 2.7%. Monthly inflation was 0.4% in September 2013. The DJIA index closed up 1.36% on Wednesday, the SPX up 1.38% and NASDAQ up 1.20%. The debt ceiling compromise came too late to impact on European markets, STOXX index closed up 0.36%, FTSE up 0.34%, CAC closed down 0.29% and the DAX up 0.47%. The MIB closed up the most by 1.45% on the day. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-17 09:00 GMT | Germany. 10-y Bond Auction 2013-10-17 12:30 GMT | USA. Initial Jobless Claims (Oct 11) 2013-10-17 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey (Oct) 2013-10-17 23:50 GMT | Japan. Foreign bond investment (Oct 11) FOREX NEWS : 2013-10-17 05:12 GMT | AUD/USD downwards despite a breach of the debt ceiling averted 2013-10-17 04:25 GMT | USD/CHF downwards despite greenback relief rally on debt progress 2013-10-17 02:32 GMT | EUR/USD jumps to 1.3550 highs; targets revisit; House says yes 2013-10-17 02:21 GMT | US House passes bill to end shutdown, raise debt ceiling ------------------------- EURUSD : HIGH 1.35521 LOW 1.35157 BID 1.35468 ASK 1.35473 CHANGE 0.11% TIME 08 : 21:46  OUTLOOK SUMMARY : Up TREND CONDITION : Down trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: Short- term tendency is bearish even though both moving averages are pointing up. Though risk of market strengthening is seen above the resistance level at 1.3555 (R1). Clearance here would open way towards to next targets at 1.3571 (R2) and 1.3588 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.3517 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.3498 (S2) and 1.3479 (S3). Resistance Levels: 1.3555, 1.3571, 1.3588 Support Levels: 1.3517, 1.3498, 1.3479 ------------------- GBPUSD : HIGH 1.59861 LOW 1.59397 BID 1.59775 ASK 1.59785 CHANGE 0.19% TIME 08 : 21:47  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: GBP/USD determined clear sideways tone on the medium-term timeframe. Possibility of market appreciation is seen above the resistance level at 1.5999 (R1). Break here is required to validate next targets at 1.6019 (R2) and 1.6042 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.5938 (S1). Possible price regress could expose our initial targets at 1.5914 (S2) and 1.5892 (S3) in potential. Resistance Levels: 1.5999, 1.6019, 1.6042 Support Levels: 1.5938, 1.5914, 1.5892 ------------------- USDJPY : HIGH 99.006 LOW 98.397 BID 98.444 ASK 98.447 CHANGE -0.31% TIME 08 : 21:47  OUTLOOK SUMMARY : Down TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: Instrument consolidates from its initial uptrend formation on the hourly chart. Resistance level at 98.82 (R1) is a key technical point on the upside. Penetration above it would suggest higher targets at 99.01 (R2) and 99.20 (R3) later on today. Downwards scenario: Prolonged movement below the initial support level at 92.28 (S1) might trigger protective orders and drive the price towards to our intraday targets at 98.10 (S2) and 97.89 (S3) later on today. Resistance Levels: 98.82, 99.01, 99.20 Support Levels: 98.28, 98.10, 97.89 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

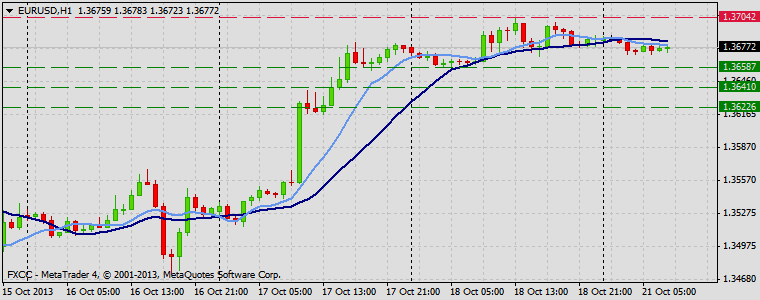

Forex Technical & Market Analysis FXCC Oct 21 2013

Forex Technical & Market Analysis FXCC Oct 21 2013

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : N/A | US CB Leading Indicator (MoM) (Sep) 2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep) 2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep) 2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11) FOREX NEWS : 2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755 2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening 2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH 2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750? ---------------------- EURUSD : HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08 : 53:03  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Low MARKET ANALYSIS - Intraday Analysis Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3). Resistance Levels: 1.3704, 1.3721, 1.3739 Support Levels: 1.3658, 1.3641, 1.3622 ---------------- GBPUSD : HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08 : 53:04  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Low Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3). Resistance Levels: 1.6225, 1.6248, 1.6269 Support Levels: 1.6148, 1.6125, 1.6102 ----------------------------- USDJPY : HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08 : 53:05  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Low Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential Resistance Levels: 98.16, 98.31, 98.46 Support Levels: 97.74, 97.59, 97.43 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

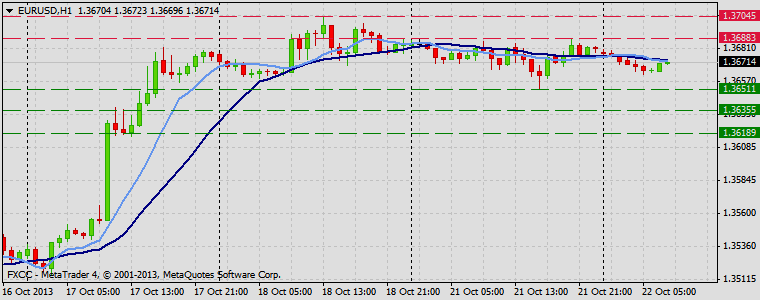

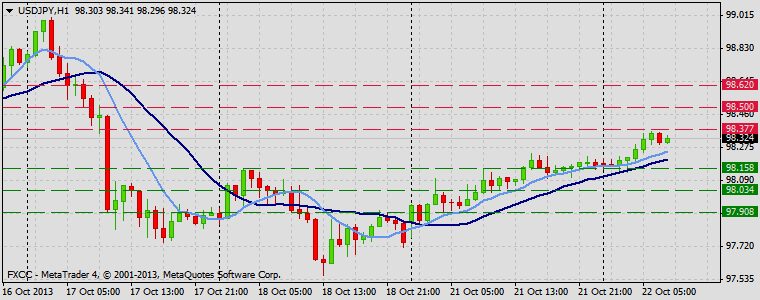

Forex Technical & Market Analysis FXCC Oct 22 2013

Forex Technical & Market Analysis FXCC Oct 22 2013

Tuesday's NFP day, let's be careful out there The big event of the day is the 18 day late publication of the NFP figures. Traders need to exercise caution as the figure might come in far better than predicted, but be subject to significant revisions due to the temporary govt. shutdown. The anticipation is for a print of 182K jobs created with the unemployment rate remaining steady at 7.3%. The benchmark 10-year yield rose two basis points, or 0.02 percentage point, to 2.60 percent as of 5 p.m in New York. The price of the 2.5 percent note due in August 2023 fell 6/32, or $1.88 per $1,000 face amount, to 99 1/8. The yield declined to 2.54 percent on Oct. 18th, the lowest since July 24th, down from a 2013 high of 3 percent on Sept. 6th.Treasury 10-year notes snapped a three-day advance before the NFP government report on Tuesday. The yen fell 0.5 percent to 98.19 per dollar after gaining 1.1 percent during the previous two days. Japan’s currency declined 0.4 percent to 134.32 per euro and touched 134.38, the weakest level since Sept. 23rd. The dollar was little changed at $1.3681 per euro after gaining 0.3 percent earlier. The U.S. Dollar Index, which monitors the greenback versus a basket of 10 other major currencies, rose 0.2 percent to 1,004.55 late in New York. The gauge fell to 1,000.70 on Oct. 18th, the lowest intraday level since Feb. 13th, extending a weekly loss to 1 percent, the most in a month. The price of crude oil fell below $100 a barrel Monday after the U.S. government reported an increase in supplies. Metals prices were broadly higher and crop prices were mixed. Crude oil for November delivery fell $1.59, or 1.6 percent, to $99.22 a barrel in New York. That's the first close below $100 a barrel since July. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-22 08:30 GMT | UK Public Sector Net Borrowing (Sep) 2013-10-22 12:30 GMT | US Nonfarm Payrolls (Sep) 2013-10-22 12:30 GMT | CA Retail Sales (MoM) (Aug) 2013-10-22 23:00 GMT | AU CB Leading Indicator (Aug) FOREX NEWS : 2013-10-22 05:15 GMT | Good Chinese data leads to little movement in the markets; traders await US data 2013-10-22 05:09 GMT | Oil sits below $100, gold consolidates 2013-10-22 04:35 GMT | GBP/USD grinds slowly lower ahead of NFP data 2013-10-22 04:12 GMT | NFP likely no to have two-way directionality as usual - Rabobank --------------------- EURUSD : HIGH 1.36806 LOW 1.36622 BID 1.36711 ASK 1.36713 CHANGE -0.07% TIME 08 : 43:23  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3688 (R1). Breakthrough here would suggest interim target at 1.3704 (R2) and then mark at 1.3721 (R3) acts as next attractive point. Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.3651 (S1) is being able to drive market price towards to our next targets at 1.3635 (S2) and 1.3618 (S3). Resistance Levels: 1.3688, 1.3704, 1.3721 Support Levels: 1.3651, 1.3635, 1.3618 ------------------- GBPUSD HIGH 1.61475 LOW 1.61154 BID 1.61274 ASK 1.61277 CHANGE -0.11% TIME 08 : 43:24  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Retracement formation remains in power. Our next resistive measure lies at 1.6148 (R1), break here is required to achieve higher targets at 1.6173 (R2) and 1.6199 (R3). Downwards scenario: Our bearish expectations remain intact below the key support level at 1.6115 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6090 (S2) and 1.6065 (S3). Resistance Levels: 1.6148, 1.6173, 1.6199 Support Levels: 1.6115, 1.6090, 1.6065 -------------------- USDJPY : HIGH 98.364 LOW 98.136 BID 98.311 ASK 98.313 CHANGE 0.14% TIME 08 : 43:25  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 98.37 (R1), break here would suggest next intraday targets at 98.50 (R2) and 98.62 (R3). Downwards scenario: On the other hand, loss of our support level at 98.15 (S1) would open road for a market decline towards to our next target at 98.03 (S2). Any further price weakening would then be limited to final support at 97.90 (S3). Resistance Levels: 98.37, 98.50, 98.62 Support Levels: 98.15, 98.03, 97.90 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

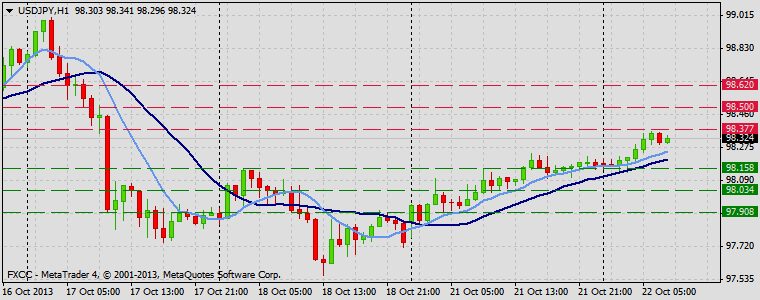

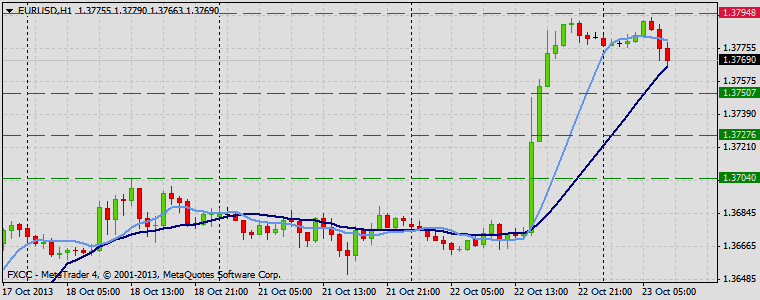

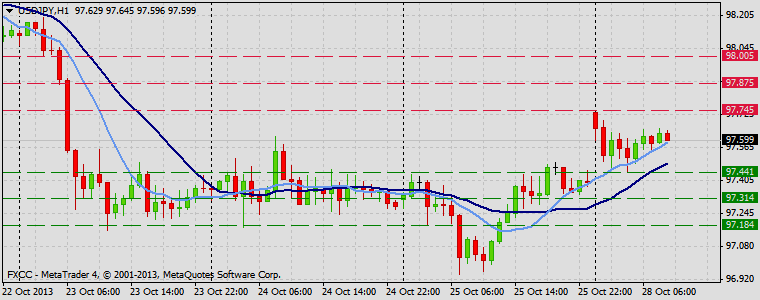

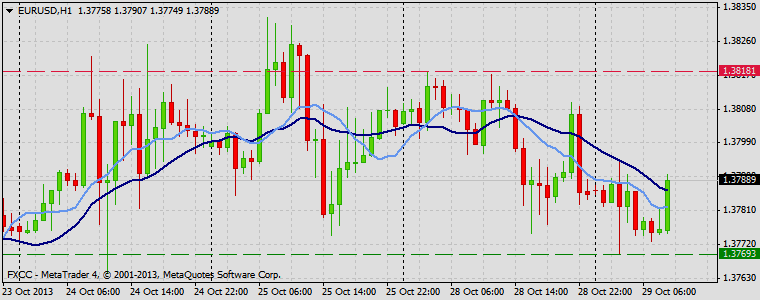

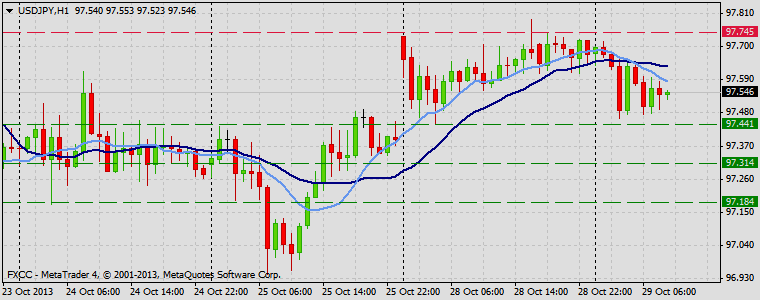

Forex Technical & Market Analysis FXCC Oct 23 2013

Forex Technical & Market Analysis FXCC Oct 23 2013

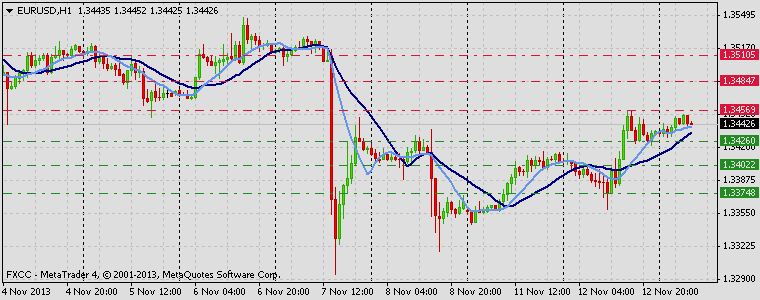

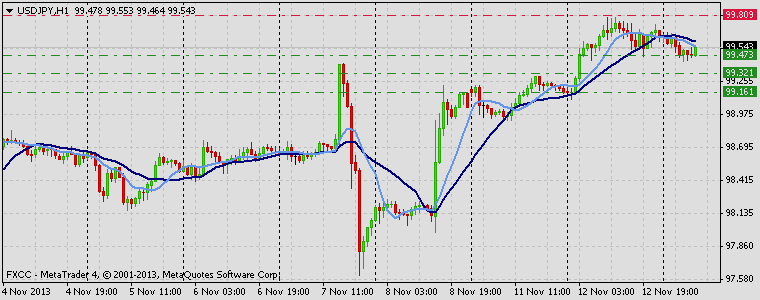

Markets rally as poor NFP print equals delayed monetary stimulus taper The DJIA closed up 0.49% on Tuesday with the SPX up 0.57% and the NASDAQ up 0.24%. European markets joined in the late afternoon rally; STOXX closing up 0.57%, UK FTSE up 0.62%, CAC up 0.43% and the DAX up 0.90%. The ASE closed up 0.45%. The leader on the board in Europe was the Swiss market index, closing up 1.12% on the day, the Swiss trade balance exceeding expectations helping the index rise, the balance was up to 2.49 bn. Equity index futures are currently flat or down marginally at the time of writing, the DJIA down 0.06%, SPX down 0.09% and the NASDAQ down 0.09%. European equity index futures are up; FTSE up 0.63%, CAC up 0.45% and the DAX up 0.84% Commodities experienced mixed fortunes on Tuesday, with WTI oil finally breaching the critical psyche level of $100 a barrel by some distance. ICE WTI oil was down 1.38% on the day to finish at $98.30 per barrel. NYMEX natural was up 0.34% on the day. COMEX gold was down 0.18% on the day at $1340.30 per ounce, with silver at $22.71 down 0.35% on the day. The dollar depreciated by 0.7 percent to $1.3781 per euro late in New York time, and touched $1.3792, the weakest level since November 2011. The greenback was little changed at 98.14 yen, while the Japanese currency lost 0.7 percent to 135.25 per euro and reached 135.51, the weakest since November 2009. The Swiss franc climbed as much as 0.9 percent to 89.40 centimes per dollar before trading at 89.47. The dollar slid to its weakest level in almost two years versus the euro after lower-than-forecast U.S. employment gains added to speculation the Federal Reserve will delay reducing stimulus. [url]http://blog.fxcc.com/market-analysis[/url] FOREX ECONOMIC CALENDAR : 2013-10-23 08:30 GMT | Bank of England Minutes 2013-10-23 14:00 GMT | BoC Interest Rate Decision (Oct 23) 2013-10-23 14:30 GMT | Bank of Canada Monetary Policy Report 2013-10-23 15:15 GMT | BoC Press Conference FOREX NEWS : 2013-10-23 05:36 GMT | USD/JPY tumbles on sharp Nikkei falls, China banks “jitters” 2013-10-23 04:48 GMT | AUD/USD retraced all of its post Australian CPI gains 2013-10-23 04:08 GMT | EUR/JPY tumbles on a corrective pullback 2013-10-23 03:42 GMT | EUR/USD rips past ‘13 peak of 1.3710 on “no tapering” hopes – continues higher Wednesday ------------------------- EURUSD : HIGH 1.37928 LOW 1.37663 BID 1.37732 ASK 1.37735 CHANGE -0.06% TIME 08 : 44:43  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: EURUSD gained momentum on the upside recently and likely resume its uptrend formation. Clearance of our next resistive structure at 1.3794 (R1) would open way towards to our initial target at 1.3821 (R2) and any further market rise would then be targeting 1.3846 (R3). Downwards scenario: On the downside bearish pressure might push the price below the support at 1.3750 (S1). Further downside extension would open road towards to next target at 1.3727 (S2) and any further losses would then be limited to 1.3704 (S3) mark. Resistance Levels: 1.3794, 1.3821, 1.3846 Support Levels: 1.3750, 1.3727, 1.3704 ---------------------- GBPUSD : HIGH 1.62567 LOW 1.62101 BID 1.62164 ASK 1.62173 CHANGE -0.11% TIME 08 : 44:44  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: Possibility of ascending structure is seen above the fractal level at 1.6259 (R1). Break here is required to clear the way towards to higher targets at 1.6286 (R2) and 1.6315 (R3). Downwards scenario: On the other hand, recovery phase might commence below the important support level at 1.6194 (S1). Break here is required to validate our targets at 1.6167 (S2) and 1.6139 (S3) later on today. Resistance Levels: 1.6259, 1.6286, 1.6315 Support Levels: 1.6194, 1.6167, 1.6139 ---------------------- USDJPY : HIGH 98.195 LOW 97.264 BID 97.440 ASK 97.443 CHANGE -0.71% TIME 08 : 44:45  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : High Upwards scenario: Possible upwards formation is limited to resistive measure at 97.56 (R1). A break above it would suggest next intraday target 97.73 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 97.89 (R3). Downwards scenario: Clearance of our support at 97.25 (S1) is required to determine negative intraday bias and enable lower target at 97.09 (S2) and then any further market depreciation would suggest final aim at 96.92 (S3). Resistance Levels: 97.56, 97.73, 97.89 Support Levels: 97.25, 97.09, 96.92 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |