Forex Technical & Market Analysis FXCC May 10 2013

Forex Technical & Market Analysis FXCC May 10 2013

Will a busy economic schedule next week be the catalyst for EUR/USD? The EUR/USD finished the day down 116 pips at 1.3044. Economic data was quiet for the most part but weekly jobless claims out of the US came in better than expected at 323k vs. 3.35k forecast. The US Dollar was well bid across the board, with the majority of action taking place in the USD/JPY which crossed the 100 threshold for the first time in four years. This seemed to help provide additional USD buying against other pairs, and also helped limit advances in commodities which were primarily lower for the day. Economic releases out of the Eurozone in the coming session include German Trade Balance, Italian Industrial Production, and EU Consumer Price Index. After the better than expected jobs number past Friday, and another week of improvement in continued claims, some analysts view it as a sign the US Dollar could be set up for further gains in coming weeks. Furthermore, if we see continued gains in USD/JPY it could also be a tailwind and help the US Dollar remain well bid in other pairs. [url]https://support.fxcc.com/email/technical/10052013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-10 12:30 GMT | US.Fed's Bernanke Speech 2013-05-10 12:30 GMT | CA.Unemployment Rate (Apr) 2013-05-10 12:30 GMT | CA.Net Change in Employment (Apr) 2013-05-10 12:30 GMT | CA.Participation rate (Apr) FOREX NEWS : 2013-05-10 04:36 GMT | Kiwi edging lower in Asia trade 2013-05-10 01:59 GMT | USD/JPY, bulls officially staring at 101.00 from the rear mirror 2013-05-10 01:03 GMT | AUD/USD feeling the selling pressure ahead of RBA statement 2013-05-10 00:28 GMT | USD/JPY completes ‘pennant’ pattern on daily chart, further gains ahead? ---------------------- EURUSD HIGH 1.30467 LOW 1.30214 BID 1.30451 ASK 1.30455 CHANGE 0.03% TIME 08 : 20:08  OUTLOOK SUMMARY Down TREND CONDITION Downward penetration TRADERS SENTIMENT Bullish IMPLIED VOLATILITY Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3056 (R1). Price extension above it is required to validate our next intraday targets at 1.3079 (R2) and 1.3105 (R3). Downwards scenario: Any downside penetration is limited to the initial support level at 1.3010 (S1). A breach of which would open a route towards to next target at 1.2987 (S2) and potentially could expose our final support for today at 1.2965 (S3). Resistance Levels: 1.3056, 1.3079, 1.3105 Support Levels: 1.3010, 1.2987, 1.2965 ---------------------- GBPUSD HIGH 1.54572 LOW 1.54377 BID 1.54487 ASK 1.54490 CHANGE 0.01% TIME 08 : 20:09  OUTLOOK SUMMARY Down TREND CONDITION Down trend TRADERS SENTIMENT Bearish IMPLIED VOLATILITY Medium Upwards scenario: Market formed gradual descending move however price appreciation is possible above the next resistance level at 1.5460 (R1). Break here is required to enable next attractive points at 1.5487 (R2) and 1.5516 (R3). Downwards scenario: Penetration below the support at 1.5427 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 1.5402 (S2) and 1.5380 (S3) might be triggered. Resistance Levels: 1.5460, 1.5487, 1.5516 Support Levels: 1.5427, 1.5402, 1.5380 ---------------------- USDJPY HIGH 101.197 LOW 100.54 BID 100.937 ASK 100.942 CHANGE 0.32% TIME 08 : 20:10  OUTLOOK SUMMARY Up TREND CONDITION Upward penetration TRADERS SENTIMENT Bearish IMPLIED VOLATILITY Medium Upwards scenario: USD/JPY continue its consolidation phase on the hourly chart. Possibility of uptrend evolvement is seen above the next resistance at 101.11 (R1). Violation here might increase bullish pressure and validate next intraday targets at 101.47 (R2) and 101.83 (R3). Downwards scenario: Further correction development is limited now to the session low - 100.56 (S1). If the price manages to surpass it we would suggest next intraday targets at 100.18 (S2) and 99.75 (S3). Resistance Levels: 101.11, 101.47, 101.83 Support Levels: 100.56, 100.18, 99.75 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC May 13 2013

Forex Technical & Market Analysis FXCC May 13 2013

Japan rests re-assured not labeled 'currency manipulator' by G7 Over the weekend, the G7 re-assured the market that Japan is not deliberately weakening the yen in order to create a competitive advantage against other industrialized nations. The group repeated its old same lines about its commitment to avoid artificial currency devaluation for domestic gain purposes, while re-iterating its commitment to avoid volatility in FX rates. According to Mike Paterson, editor at Forexlive: "The general consensus seems to be they accept Japan’s arguments that their dramatic easing on monetary policy is aimed at combating deflation rather than weaker currency advantage." Mr. Paterson thinks the last developments in the G7 meeting "should be the green light for further yen selling when markets re-open given that it takes the uncertainty out of the equation but the announcement was hardly a surprise" he said. It will be interesting to see just how much weaker it gets in the early stages. Failure to drop too far will suggest that there rightly should be an air of caution after such rapid falls. But as the say goes, all that glitters is not gold, and US, Canada and Germany were all suspiciously more notorious on voicing out a closer monitoring over Japan's next policy actions. As Mr. Paterson rightly points out, "behind the scenes of G7, sure there is not such a united front as they wish to portray." U.S. Treasury Secretary Jack Lew had something to say on yen weakness: “We’ll keep an eye on that”, suggesting that any signs of currency manipulation by Japan will be watch very closely, adding that Japan had “growth issues.” Japan's Finance Minister Mr. Aso confirmed to media reporters that no criticism was noted on Japan’s monetary easing. [url]https://support.fxcc.com/email/technical/13052013/[/url] FOREX ECONOMIC CALENDAR : 24h | EMU. Eurogroup meeting 2013-05-13 12:30 GMT | USA. Retail Sales 2013-05-13 14:00 GMT | USA. Business Inventories (Mar) 2013-05-13 22:45 GMT | New Zeland. Retail Sales FOREX NEWS : 2013-05-13 04:32 GMT | EUR/USD uncomfortable below 1.30, further definition needed 2013-05-13 04:21 GMT | USD extends gains; Gold takes a hit 2013-05-13 03:34 GMT | Gold selling off sharply below $1430 2013-05-13 03:24 GMT | USD/JPY, expect little pullback in the high 101s - RBS EURUSD : HIGH 1.29781 LOW 1.29595 BID 1.29756 ASK 1.29758 CHANGE -0.12% TIME 08 : 04:42  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT :Bullish IMPLIED VOLATILITY :Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Neutral hourly studies point towards further consolidation, with a break of next resistive structure at 1.3011 (R1) is required to spark stronger upside action. In such scenario we would suggest our next initial targets at 1.3036 (R2) and 1.3062 (R3). Downwards scenario: Medium-term bias is clearly negative. Possible progress below the initial support level at 1.2957 (S1) might expose our intraday targets at 1.2934 (S2) and then 1.2909 (S3). Resistance Levels: 1.3011, 1.3036, 1.3062 Support Levels: 1.2957, 1.2934, 1.2909 ------------------------ GBPUSD : HIGH 1.53578 LOW 1.53357 BID 1.53519 ASK 1.53529 CHANGE -0.07% TIME 08 : 04:42  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT :Bullish IMPLIED VOLATILITY :Low Upwards scenario: GBPUSD is consolidating today however we see potential for further appreciation towards to our targets at 1.5403 (R2) and 1.5429 (R3) if the price manages to overcome key resistance measure at 1.5377 (R1). Downwards scenario: Next support level is seen at 1.5334 (S1), any penetration below it might activate further downside pressure and enable lower target at 1.5310 (S2). Any further market decline would then be limited to final support at 1.5284 (S3). Resistance Levels: 1.5377, 1.5403, 1.5429 Support Levels: 1.5334, 1.5310, 1.5284 ------------------ USDJPY : HIGH 102.151 LOW 101.74 BID 101.751 ASK 101.752 CHANGE 0.14% TIME 08 : 04:43  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT :Bearish IMPLIED VOLATILITY :Low Upwards scenario: Further uptrend development is possible above the next resistance level at 102.18 (R1). Break here would open route towards to higher target at 102.65 (R2) and any further price advance would then be limited to 103.12 (R3). Downwards scenario: On the other hand, a break of the support at 101.44 (S1) is required to determine negative intraday bias and enable lower target at 101.01 (S2). Clearance of this target would open a path towards to final support for today at 100.57 (S3). Resistance Levels: 102.18, 102.65, 103.12 Support Levels: 101.44, 101.01, 100.57 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] ECN Broker | Forex Practice Account | Forex Trading Blog | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 14 2013

Forex Technical & Market Analysis FXCC May 14 2013

Schäuble suggests revising EU treaties to make way for banking union German finance minister Wolfgang Schäuble told the Financial Times today that the banking union could not be completed without a modification of EU treaties. The process of changing them however could last several months or even years. According to Schäuble the existing treaties “do not suffice” to allow for forming a strong central resolution authority. Therefore he warned against making promises which the EU cannot keep, as they would directly affect its credibility. “The EU does not have coercive means to enforce decisions” Schäuble said. “What it has are responsibilities and powers defined by its treaties.” A change to the treaties would provide a better separation of the ECB's monetary and supervisory functions. The German finance minister is conscious that such changes might take a long time, so he proposed a two-step process consisting of a resolution mechanism based on a network of national authorities as well as a network of resolution funds. Even though Schäuble acknowledges that such a structure would not be trons enough in the long term, he believes that it would allow to buy time and create the base for reaching the final objective: a European banking union, which encompasses the entire interior market. [url]https://support.fxcc.com/email/technical/14052013/[/url] FOREX ECONOMIC CALENDAR : 24h | EMU. EcoFin Meeting 2013-05-14 06:00 GMT | Germany. Consumer Price Index 2013-05-14 09:00 GMT | Germany. ZEW Survey - Economic Sentiment 2013-05-14 09:30 GMT | Australia. Budget Release FOREX NEWS : 2013-05-14 04:28 GMT | Look to get long EUR/JPY into support levels 2013-05-14 03:58 GMT | EUR/USD still range bound ahead of busy economic calendar week 2013-05-14 03:46 GMT | AUD/USD, outlook is bearish but be patient - RBS 2013-05-14 03:11 GMT | GBP/USD completes ‘bear flag’ pattern on daily chart EURUSD : HIGH 1.30261 LOW 1.29693 BID 1.30029 ASK 1.30033 CHANGE 0.21% TIME 08 : 33:12  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Possibility of uptrend penetration is seen above the next resistance level at 1.3026 (R1). Clearance here might enable bullish pressure and let the price to achieve our intraday targets at 1.3044 (R2) and 1.3062 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 1.2992 (S1). Loss here might change intraday technical structure and opens the way for a test of 1.2971 (S2) and 1.2951 (S3) later on today. Resistance Levels: 1.3026, 1.3044, 1.3062 Support Levels: 1.2992, 1.2971, 1.2951 -------------------- GBPUSD : HIGH 1.5331 LOW 1.52939 BID 1.53144 ASK 1.53152 CHANGE 0.1% TIME 08 : 33:12  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.5334 (R1). Price extension above it is required to validate our next intraday targets at 1.5358 (R2) and 1.5383 (R3) Downwards scenario: On the other hand if the price manages to overcome our next support barrier at 1.5296 (S1), we expect to see further market decline towards to our target at 1.5272 (S2) and then next stop could be found at 1.5249 (S3) mark. Resistance Levels: 1.5334, 1.5358, 1.5383 Support Levels: 1.5296, 1.5272, 1.5249 ------------------------- USDJPY : HIGH 101.849 LOW 101.365 BID 101.439 ASK 101.441 CHANGE -0.37% TIME 08 : 33:13  OUTLOOK SUMMARY : Up TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 101.78 (R1), clearance here is required to enable next resistances at 102.22 (R2) and last one at 102.67 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 101.21 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 100.77 (S2) and 100.35 (S3) later on. Resistance Levels: 101.78, 102.22, 102.67 Support Levels: 101.21, 100.77, 100.35 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] ECN Forex Software | The Best Forex Broker | Forex Account | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 15 2013

Forex Technical & Market Analysis FXCC May 15 2013

EU gives the go-ahead to Spanish bank restructuring plan The European Commission announced on Wednesday its approval of the plans to restructure Spain's four nationalized banks: Bankia, Nova Caixa Galicia, Catalunya Caixa and Banco de Valencia. Vice President of the European Commission responsible for Competition Policy Joaquín Almunia said in the European morning that the injection of 37 billion euros of the bank rescue would require a 60% reduction in the size of the nationalized financial institutions by 2017. Joaquín Almunia informed that during the negotiations with Spanish authorities and the banks in question it was established that the recapitalization funds would be distributed as follows: 18 billion euros for Bankia, 9 billion for Catalunya Caixa, 5.5 billion for Nova Caixa Galicia and 4.5 billion for Banco de Valencia. The four nationalized financial institutions should abandon conceding loans for high risk activities and should transfer 45 billion euros of toxic assets to the newly created bad bank. Catalunya Caixa and Nova Caixa Galicia are expected to be sold before 2017. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-15-2013/[/url] FOREX ECONOMIC CALENDAR : 2012-11-29 08:55 GMT | Germany. Unemployment Change (Nov) 2012-11-29 10:30 GMT | United Kingdom. BoE's Governor King Speech 2012-11-29 13:30 GMT | United States. Gross Domestic Product Annualized (Q3) 2012-11-29 15:00 GMT | United States. Pending Home Sales (MoM) (Oct) FOREX NEWS : 2012-11-29 06:12 GMT | EUR/GBP flat below 0.8100, 50% Fibo 2012-11-29 05:36 GMT | GBP/USD trying to push higher, eyeing 1.6020 2012-11-29 05:25 GMT | NZD/USD higher on US 'fiscal cliff' optimism 2012-11-29 04:09 GMT | EUD/USD bullish while above 1.2885 – Scotiabank -------------------- Forex Technical Analysis EURUSD :  MARKET ANALYSIS – Intraday Analysis Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3). Resistance Levels: 1.2962, 1.2980, 1.2996 Support Levels: 1.2939, 1.2921, 1.2903 ------------------ Forex Technical Analysis GBPUSD :  Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3). Resistance Levels: 1.6021, 1.6031, 1.6042 Support Levels: 1.6005, 1.5994, 1.5983 ------------------- Forex Technical Analysis USDJPY :  Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3). Resistance Levels: 82.22, 82.30, 82.39 Support Levels: 82.00, 81.91, 81.82 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

Forex Technical & Market Analysis FXCC May 16 2013

Forex Technical & Market Analysis FXCC May 16 2013

BoE sees a modest and sustained recovery over the next three years The quarterly Inflation Report released by the Bank of England on Wednesday suggests that UK inflation should rise above 3% in June and that it will possibly remain above the 2% target for the next two years. As for the GDP, it is “likely to pick up gradually over the next year or so, supported by past asset purchases, an easing in credit conditions aided by the Funding for Lending Scheme, and a continuing improvement in the global environment.” The BoE MPC expects GDP growth of 0.3% in the first quarter of 2013. In the current quarter they see quarterly GDP expanding by 0.5%, while year-on-year GDP is projected to grow by 2.2% (compared with the previous forecast of 2%). Nevertheless, the MPC recognizes that the recovery is still “weak and uneven.” The report states that in the light of the growth and inflation forecasts more stimulus might be required. No rate hike should be carried out before 2016 however. Following the release of the report, BoE Governor Mervyn King presented it at a press conference. He pointed out that there are many obstacles on UK's road to recovery, the most important being the Eurozone crisis and rising unemployment. He stressed that UK policymakers should continue their efforts to boost the recovery as “this is no time to be complacent.” [url]http://blog.fxcc.com/forex-technical-market-analysis-may-16-2013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-15 09:00 GMT | EMU. Consumer Price Index 2013-05-15 12:30 GMT | USA. Consumer Price Index 2013-05-15 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey 2013-05-15 19:05 GMT | USA. FOMC Member Williams speech FOREX NEWS : 2013-05-15 19:24 GMT | EUR/USD seen at 1.2600 in 3 months – UBS 2013-05-15 18:55 GMT | GBP/JPY is unable to break above 156.00 2013-05-15 18:41 GMT | USD/CHF retests daily lows 2013-05-15 18:19 GMT | AUD/USD's recovery capped at 0.9920, back to 0.9870 -------------------- Forex Technical Analysis EURUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3). Resistance Levels: 1.2962, 1.2980, 1.2996 Support Levels: 1.2939, 1.2921, 1.2903 --------------------- Forex Technical Analysis GBPUSD :  Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3). Resistance Levels: 1.6021, 1.6031, 1.6042 Support Levels: 1.6005, 1.5994, 1.5983 -------------------------- Forex Technical Analysis USDJPY :  Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3). Resistance Levels: 82.22, 82.30, 82.39 Support Levels: 82.00, 81.91, 81.82 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] ECN Broker Account | Currency Converter | Forex Blog | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 17 2013

Forex Technical & Market Analysis FXCC May 17 2013

Talking Down the EUR The euro came under selling pressure today against the U.S. dollar after European Industry Commissioner Tajani tried to talk down the currency. As the head of an agency whose goal is to protect the export sector, Tajani complained that the euro is too strong and called on the central bank to manage the currency in a way that would help exports. Considering that the euro has been in a downtrend since the beginning of the month and has lost over 5% since the beginning of February, some investors may be surprised by the timing of Tajani's comments. However it is clear that underperformance of the Eurozone economy, which is currently in recession is a big motivation for industry officials, politicians and central bankers to make overtures to weaken the euro now versus February. In addition, with the currency in a downtrend, comments such as these will have a greater impact on the euro. As the ECB considers whether to introduce negative deposit rates or purchases of asset backed securities, a weaker currency will provide additional support to the region's economy. [url]https://support.fxcc.com/email/technical/17052013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-17 09:00 GMT | EMU. Construction Output w.d.a (YoY) (Mar) 2013-05-17 12:30 GMT | Canada. Consumer Price Index (YoY) (Apr) 2013-05-17 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment Index (May) 2013-05-17 15:00 GMT | USA. CB Leading Indicator (MoM) (Apr) FOREX NEWS : 2013-05-17 04:58 GMT | Nomura's survey on USDJPY suggest higher quotes 2013-05-17 04:26 GMT | Technical picture continues to become more bearish for EUR/USD 2013-05-17 03:57 GMT | AUD/USD, how far can it go? 0.9750/10 next demand 2013-05-17 02:40 GMT | USD/CHF inching toward hourly resistance trend line at 0.9675 EURUSD : HIGH 1.28897 LOW 1.2855 BID 1.28676 ASK 1.28680 CHANGE -0.1% TIME 08 : 26:30  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: 20 SMA acts as next resistance level at 1.2886 (R1). Penetration above that mark might trigger upside pressure and expose our next resistive mean at 1.2911 (R2) en route towards to final target for today at 1.2937 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.2843 (S1) Market would create a signal of bearish sentiment and enable our interim target at 1.2819 (S2). Final support for today locates at 1.2794 (S3). Resistance Levels: 1.2886, 1.2911, 1.2937 Support Levels: 1.2843, 1.2819, 1.2794 ----------------------- GBPUSD : HIGH 1.52822 LOW 1.52366 BID 1.52521 ASK 1.52533 CHANGE -0.1% TIME 08 : 26:30  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: A bearish tone dominates during the Asian session however further buying interest might arise above the resistance at 1.5281 (R1). Clearance here would suggest next intraday target at 1.5315 (R2) and if the price holds its momentum we can expect an increase towards to 1.5351 (R3). Downwards scenario: If the price failed to establish further positive bias today, likely we will see retest of our key support level at 1.5228 (S1). Break here is required to enable initial lower targets at 1.5194 (S2) and 1.5163 (S3) in potential. Resistance Levels: 1.5281, 1.5315, 1.5351 Support Levels: 1.5228, 1.5194, 1.5163 -------------------------- USDJPY : HIGH 102.371 LOW 102.08 BID 102.291 ASK 102.295 CHANGE 0.04% TIME 08 : 26:31  OUTLOOK SUMMARY : Neutral TREND CONDITION : Sideway TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Neutral channel formation remains in play on the hourly chart. Our next resistance level is placed at 102.47 (R1). Strengthening above it would point to resistive structure at 102.81 (R2) onto 103.14 (R3). Downwards scenario: Possible downtrend evolvement might occur below the immediate support level at 102.05 (S1). Clearance here is required to enable our next targets at 101.70 (S2) and 101.36 (S3) in potential. Resistance Levels: 102.47, 102.81, 103.14 Support Levels: 102.05, 101.70, 101.36 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] ECN Broker List | Forex Trading Account | Currency Converter | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 20 2013

Forex Technical & Market Analysis FXCC May 20 2013

Bearish developments on EUR/USD charts continue to take shape It was a rough week for the EUR/USD, as continued speculation of the Fed tapering QE purchases and worries of economic growth in Europe continued to put pressure on the pair throughout the week. When all was said and done, the pair finished the week down 0.90% to close at 1.2838. Market participants will be focusing on a number reports this week including testimony from Fed Chairman Bernanke, as well as speeches by some regional Fed officials. According to Greg Gibbs, FX Trading Strategist at RBS,“the market will be looking closely at the Fed commentary this week. Bernanke's testimony to Congress on Wednesday is the main focal point, but there are important speeches by doves Evans and Dudley before then. As key supporters of maintaining the current $85bn pace of asset purchases, any shift in their tone will be seen as evidence that the consensus and Bernanke's views have shifted.” He went on to add, “the commentary by Fed Watcher Hilsenrath just over a week ago and by a Fed dove Williams on Thursday last week has got the market thinking about potential for QE tapering in the summer, which puts into play the 19 June, 31 July or 18 September meetings. The June meeting includes a Bernanke press conference and staff projects, as does the September meeting.” [url]http://blog.fxcc.com/forex-technical-market-analysis-may-20-2013/[/url] FOREX ECONOMIC CALENDAR 2013-05-20 12:30 GMT | US.Chicago Fed National Activity Index (Apr) 2013-05-20 17:00 GMT | US.Fed's Evans Speech 2013-05-20 19:00 GMT | AR.Unemployment Rate (QoQ) (Q1) 2013-05-20 21:45 GMT | NZ.Visitor Arrivals (YoY) (Apr) FOREX NEWS 2013-05-20 02:45 GMT | Sterling bulls continue to defend the 1.5150 level 2013-05-20 02:32 GMT | AUD/USD higher above 0.9750 on USD weakness 2013-05-20 00:27 GMT | EUR/JPY buyers step in again at 131.00, support remains firm 2013-05-19 23:11 GMT | EUR/USD capped below 1.2850 ---------------------- Forex Technical Analysis EURUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Bullish market sentiment is slightly improved yesterday however further appreciation needs to clear barrier at 1.2855 (R1) to enable our interim target at 1.2882 (R2) and then any further gains would be limited to last resistance at 1.2908 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.2818 (S1), we expect to see further market decline towards to our next target at 1.2800 (S2) and then next stop could be found at 1.2780 (S3) mark. Resistance Levels: 1.2855, 1.2882, 1.2908 Support Levels: 1.2818, 1.2800, 1.2780 ------------------------------- Forex Technical Analysis GBPUSD :  Upwards scenario: Next immediate resistive barrier is seen at 1.5209 (R1). If instrument gains momentum on the upside and manage to overcome it we would focus on the intraday targets at 1.5241 (R2) and 1.5276 (R3) in potential. Downwards scenario: Any downside extension is limited now to the next support level at 1.5163 (S1). Break here is required to open a route towards to next target at 1.5141 (S2) and then any further easing would be targeting final support at 1.5117 (S3). Resistance Levels: 1.5209, 1.5241, 1.5276 Support Levels: 1.5163, 1.5141, 1.5117 ------------------------ Forex Technical Analysis USDJPY :  Upwards scenario: Possible upwards formation is limited now to resistive measure at 102.87 (R1). A break above it would suggest next intraday target at 103.29 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 103.75 (R3). Downwards scenario: Pair looks likely to test our supportive means today. Devaluation below the support at 102.62 (S1) would initiate bearish pressure. On the way our next interim support at 102.39 (S2) en route to final target at 102.07 (S3). Resistance Levels: 102.87, 103.29, 103.75 Support Levels: 102.62, 102.39, 102.07 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] FX Central Clearing Ltd [/url] ) |

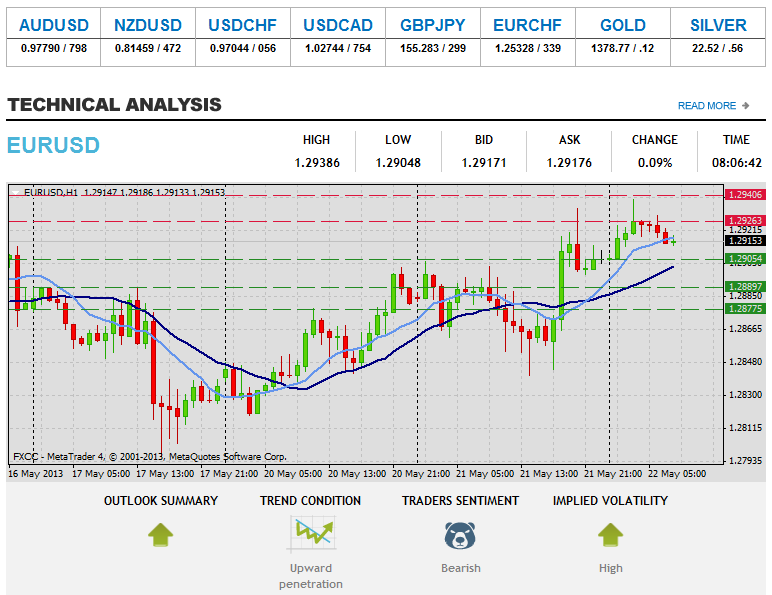

Forex Technical & Market Analysis FXCC May 21 2013

Forex Technical & Market Analysis FXCC May 21 2013

Fed-Speak to dominate EUR/USD trading in coming days The EUR/USD was able to claw back a small portion of its losses suffered last week, finishing the day up 64 pips at 1.2884. Economic news was light on the session with European markets closed and no releases out of the US. Market participants will be expecting volatility to really pick up later in the week when we see Fed Chairman Bernanke’s testimony to Congress, the release of the most recent FOMC minutes, and a number of other regional Fed speakers on the wires. Given the recent market buzz of the prospects of Fed tapering QE, the next few days could help set a more established trend for the pair as we near month end. According to Marc Chandler, Head Currency Strategist at BBH, “in the US, the FOMC minutes from the April 30/May 1 meeting will be released on Wednesday. Markets will be parsing them very thoroughly for any clues about QE tapering. Those minutes will be sandwiched between another heavy slate of Fed speakers including Bullard and Dudley on Tuesday, Bernanke testimony on Wednesday, and Bullard again on Thursday. Bernanke’s testimony will be the most important, of course. While we expect the key Fed officials to signal steady as she goes with regards to QE, we acknowledge that markets could see some turbulence.” Other analysts also mention to keep a focus on Europe, as we will see a number of important PMI releases from the region later in the week as well as speeches from important European officials including ECB President Draghi. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-21-2013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-21 06:00 GMT | Germany. Producer Price Index (YoY) (Apr) 2013-05-21 08:30 GMT | UK. Consumer Price Index (YoY) (Apr) 2013-05-21 14:00 GMT | USA. Treasury Sec Lew Speech 2013-05-21 23:50 GMT | Japan. Merchandise Trade Balance Total (Apr) FOREX NEWS : 2013-05-21 04:36 GMT | Fed-Speak to dominate EUR/USD trading in coming days 2013-05-21 04:26 GMT | USD/JPY, break through 103.5 allows 105/105.50 – JPMorgan 2013-05-21 03:19 GMT | EUR/JPY continues to eye upper end of range near 133.00 2013-05-21 01:48 GMT | AUD/USD consolidates below 0.9800 after RBA minutes release --------------------- Forex Technical Analysis EURUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: On the upside market might get more incentives above the immediate resistive barrier at 1.2905 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.2930 (R2) and 1.2955 (R3). Downwards scenario: On the other hand, possible downtrend development may encounter supportive measure at 1.2860 (S1). Penetration through this level would targeting then supportive means at 1.2836 (S2) and 1.2811 (S3) later on today. Resistance Levels: 1.2905, 1.2930, 1.2955 Support Levels: 1.2860, 1.2836, 1.2811 ---------------------------- Forex Technical Analysis GBPUSD :  Upwards scenario: While both moving averages are pointing down, medium-term technical outlook would be positive. Key resistance level lie at 1.5281 (R1), above here opens a route towards to our initial targets at 1.5308 (R2) and 1.5336 (R3). Downwards scenario: Local low at 1.5221 (S1) offers next immediate support barrier. Successful penetration below it would open path towards to next intraday targets at 1.5194 (S2) and 1.5165 (S3). Resistance Levels: 1.5281, 1.5308, 1.5336 Support Levels: 1.5221, 1.5194, 1.5165 --------------------------- Forex Technical Analysis USDJPY :  Upwards scenario: On the upside resistive structure at 102.77 (R1) prevents further gains. Clearance here is required to open route towards to next target at 103.10 (R2) and then final target could be triggered at 103.43 (R3). Downwards scenario: On the other hand, pair keeps the consolidation pattern intact. We see potential to positively retest supportive barrier at 102.19 (S1). Depreciation below it would open route towards to initial targets at 101.86 (S2) and 101.52 (S3) in potential. Resistance Levels: 102.77, 103.10, 103.43 Support Levels: 102.19, 101.86, 101.52 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] ECN FX Broker Platform | Forex Account | Currency Converter | FXCC [/url] ) |

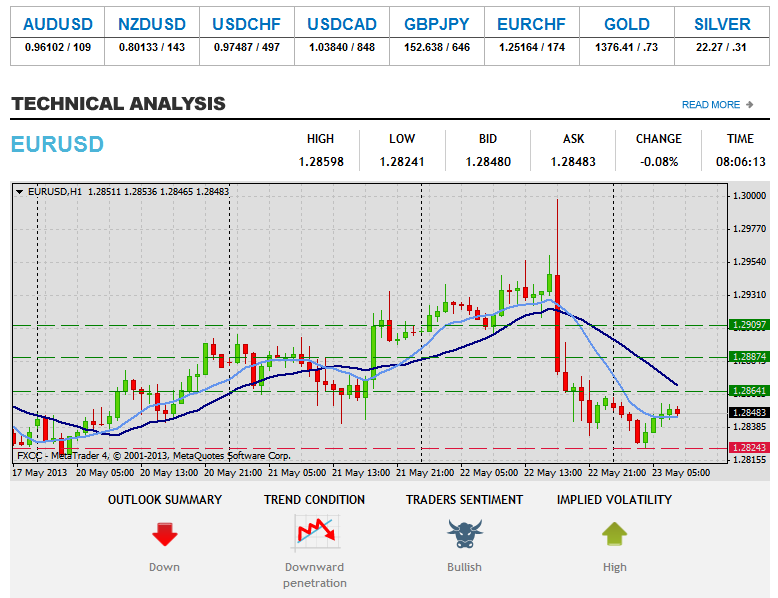

Forex Technical & Market Analysis FXCC May 22 2013

Forex Technical & Market Analysis FXCC May 22 2013

Bernanke testimony, FOMC minutes, & European data to heighten EUR/USD volatility The EUR/USD finished the day moderately higher, closing up 25 pips at 1.2905 ahead of what is sure to be a volatile session with Fed Chairman Bernanke set to testify in front of congress at 14:00GMT. Furthermore, we will also see the release of the most recent FOMC minutes at 18:00GMT. According to Sean callow of Westpac,“The US calendar is dominated by Fed chairman Bernanke’s testimony on “The Economic Outlook” to the Joint Economic Committee of Congress (10am NY time). He will deliver a prepared text then take numerous questions from both friendly and hostile lawmakers. Volatility over the course of his appearance seems assured, as markets try to quickly decide whether Bernanke is trying to dampen talk of reducing QE some time soon, is affirming such a view or remaining non-committal. USD should gain in the latter two scenarios but we still expect the first outcome – Bernanke arguing that it is too soon to be confident that the economy is recovering sustainably.” Other analysts are pointing towards European economic data as the additional catalysts for the EUR/USD which may help to break the recent range bound activity. Market participants should be aware that later in the week will see a number of European PMI figured which could also heighten volatility. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-22-2013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-22 12:30 GMT | Canada.Retail Sales (MoM) (Mar) 2013-05-22 14:00 GMT | USA.Existing Home Sales (MoM) (Apr) 2013-05-22 14:00 GMT | USA.Fed's Bernanke testifies 2013-05-22 18:00 GMT | USA.FOMC Minutes FOREX NEWS : 2013-05-22 03:26 GMT | USD/JPY steady near 102.50 after BoJ Monetary Policy release 2013-05-22 02:43 GMT | AUD/USD still around 0.98 despite worsening consumer confidence in | Australia 2013-05-22 02:41 GMT | GBP/JPY – Will buyers have enough force to take out 156.80 resistance? 2013-05-22 00:22 GMT | EUR/USD working its way higher thru 1.2920/40 supply ----------------------- Forex Technical Analysis EURUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.2926 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.2940 (R2) and 1.2955 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 1.2905 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 1.2889 (S2) and 1.2877 (S3) later on. Resistance Levels: 1.2926, 1.2940, 1.2955 Support Levels: 1.2905, 1.2889, 1.2877 ---------------------- Forex Technical Analysis GBPUSD :  Upwards scenario: Next actual resistance level is seen at 1.5160 (R1). If the market manages to surge higher, our focus would returned to the next target at 1.5179 (R2) and further recovery action could be exhausted at 1.5197 (R3) intraday. Downwards scenario: Price regress below the support level at 1.5128 (S1) would increase likelihood of failing towards to our key supportive barrier at 1.5110 (S2) and any further market decline would then be targeting final support for today at 1.5092 (S3). Resistance Levels: 1.5160, 1.5179, 1.5197 Support Levels: 1.5128, 1.5110, 1.5092 --------------------- Forex Technical Analysis USDJPY :  Upwards scenario: Any upside actions looks limited to resistance level at 102.64 (R1). Surpassing of this level might enable next target at 102.73 (R2) and any further gains would then be targeting final mark at 102.86 (R3) in potential. Downwards scenario: Our next support level at 102.44 (S1) limits possible recovery attempts for now. Break here is required to establish negative market sentiment and enable lower target at 102.35 (S2) en route to final target at 102.25 (S3). Resistance Levels: 102.64, 102.73, 102.86 Support Levels: 102.44, 102.35, 102.25 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Forex Training | Currency Converter | ECN Forex Trading Accounts | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 23 2013

Forex Technical & Market Analysis FXCC May 23 2013

FOMC minutes show members open to tapering QE The minutes from the April 30 and May 1 FOMC meeting showed that "a number" of officials expressed willingness to taper the bond buying program as early as the June meeting "if the economic information received by that time showed evidence of sufficiently strong and sustained growth". However, according to the minutes, views differed about what evidence would be necessary and the likelihood of that outcome. One Fed official wanted to stop the bond purchases immediately, while another wanted to increase the size of the program. Despite the discrepancies, most members emphasized importance of being prepared to adjust purchases either up or down. The minutes also revealed the Fed started a review of their exit strategy principles last released to the public in 2011. The broad principles appeared generally still valid, but the bank will probably need greater flexibility regarding the details of implementing policy normalization. The greenback surged against majority of its person Wednesday after Fed Chairman Ben Bernanke hinted at possibilities of the central bank slowing its bond purchases. Initially, dollar briefly dropped across the board after Bernanke said monetary stimulus is helping the U.S.economy recovery. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-23-2013/[/url] FOREX ECONOMIC CALENDAR 2013-05-23 07:30 GMT ECB President Draghi's Speech senectus 2013-05-23 08:30 GMT Gross Domestic Product (YoY) (Q1) 2013-05-23 12:30 GMT Initial Jobless Claims (May 17) 2013-05-23 14:00 GMT New Home Sales (MoM) (Apr) FOREX NEWS 2013-05-23 04:13 GMT More volatility expected with EU PMI on tap 2013-05-23 03:32 GMT USD/JPY turns below 103.5 on bad China data 2013-05-23 03:09 GMT GBP/JPY edging lower towards support at 154.50 2013-05-23 03:01 GMT AUD/NZD glued to 1.20 despite Aussie disaster ------------------------ Forex Technical Analysis EURUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: EURUSD broke all supportive measure yesterday and currently stabilized near its lows. Appreciation above the resistive barrier at 1.2864 (R1) is compulsory to commence positive market structure and validate next intraday targets at 1.2887 (R2) and 1.2909 (R3). Downwards scenario: However our both moving averages are pointing down and if the price manages to break our key support level at 1.2824 (S1) we would expect further depreciation towards to our next targets, located at 1.2803 (S2) and 1.2781 (S3). Resistance Levels: 1.2864, 1.2887, 1.2909 Support Levels: 1.2824, 1.2803, 1.2781 ----------------------- Forex Technical Analysis GBPUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Prolonged movement yesterday on the downside determined negative bias on the short-term perspective. Though possible penetration above the resistance level at 1.0573 (R1) might keep bulls in play, targeting next resistances at 1.5109 (R2) and 1.5145 (R3). Downwards scenario: The downside direction remains favored according to the technical indicators. Our key support measure lies at 1.5010 (S1). Decline below it would enable next targets located at 1.4978 (S2) and 1.4944 (S3). Resistance Levels: 1.5073, 1.5109, 1.5145 Support Levels: 1.5010, 1.4978, 1.4944 -------------------------- Forex Technical Analysis USDJPY MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Price accelerates on the downside recently and likelihood of closing on the positive side today is low. However price appreciation the next resistance level at 102.25 (R1) would suggest next initial targets at 102.55 (R2) and 102.84 (R3). Downwards scenario: Next barrier on the way is seen at 101.76 (S1). Break here would open way towards to next intraday target at 101.48 (S2) and then final aim locates at 101.19 (S3). Resistance Levels: 102.25, 102.55, 102.84 Support Levels: 101.76, 101.48, 101.19 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

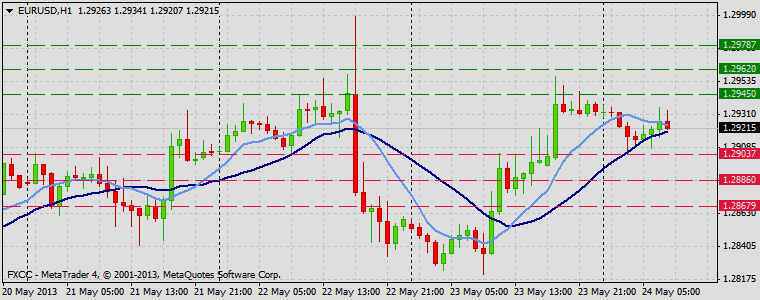

Forex Technical & Market Analysis FXCC May 24 2013

Forex Technical & Market Analysis FXCC May 24 2013

Will German GDP/IFO be the catalyst to take EUR/USD back above 1.3000? The EUR/USD finished the session sharply higher, mainly benefiting from a better than expected European PMI data print. It will be another busy upcoming economic session in Europe, with German GDP due out at 6:00GMT, followed by German IFO at 8:00GMT. One has to ask, if the print comes in better than expected, will it be enough to take the pair back above the critical resistance level of 1.3000(the 20dma)? According to analysts at Rabobank, “there was a modestly firmer tone, maybe a ‘less downbeat tone’ is a better description because despite improvement they remain sub-50, to the suite of eurozone PMIs. In Germany, the Manufacturing PMI gained to 49.0, up from April’s 48.1 and the Services PMI ticked up to 49.8 from 49.6. France’s Manufacturing PMI increased to 45.5 from 44.4 and the Services PMI held steady at 44.3. For the eurozone as a whole, the Manufacturing PMI gained to 47.8 from April’s 46.7.” They went on to add,“there’s no particularly strong message in these data but they are consistent with our thinking – and that of the ECB – that Europe’s economy will show some improvement as this year unfolds. Calmer financial market conditions should pay a positive dividend to the real economy over time.” The ‘risk on’ vs. ‘risk off’ sentiment of the equity market will also be something to keep in mind. It was interesting to see the EUR/USD go well bid on a day when the Nikkei dropped 7%. However, its hard to imagine this correlation continuing should US equities start a serious correction. Furthermore, some analysts believe that just because the recent EU PMI data came in better than expected, EU officials will not deviate from the dovish rhetoric which has been plentiful in recent weeks. [url]https://support.fxcc.com/email/technical/24052013/[/url] FOREX ECONOMIC CALENDAR : 2013-05-24 06:00 GMT | Germany. Gfk Consumer Confidence Survey (Jun) 2013-05-24 08:00 GMT | Germany. IFO - Business Climate (May) 2013-05-24 10:00 GMT | Germany. German Buba President Weidmann speech 2013-05-24 12:30 GMT | USA. Durable Goods Orders (Apr) FOREX NEWS : 2013-05-24 04:14 GMT | USD/JPY breaks below 102 like hot butter once again 2013-05-24 04:03 GMT | AUD/USD gets pounded down to 0.9650 2013-05-24 03:21 GMT | Sterling holds support at previous lows, continues to find aggressive bids near 1.5000 2013-05-24 02:13 GMT | GBP/JPY closes below 20dma for first time since April 5th EURUSD : HIGH 1.2937 LOW 1.29041 BID 1.29290 ASK 1.29294 CHANGE -0.03% TIME 08 : 17:53  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: EURUSD consolidates prior macroeconomic news announcement. Our next resistive barrier is seen at 1.2945 (R1). Break here is required to drive market price towards to next visible targets at 1.2962 (R2) and 1.2978 (R3) later on today. Downwards scenario: Although market players may prefer to increase exposure on the short positions and push the price below the support level at 1.2903 (S1). Possible price devaluation would suggest next initial targets at 1.2886 (S2) and then 1.2867 (S3). Resistance Levels: 1.2945, 1.2962, 1.2978 Support Levels: 1.2903, 1.2886, 1.2867 ---------------------- GBPUSD : HIGH 1.51139 LOW 1.50639 BID 1.51015 ASK 1.51026 CHANGE -0.02% TIME 08 : 17:53  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: GBPUSD retraced after the initial downtrend formation. Next resistive barrier on the way is mark at 1.5119 (R1). Loss here is required to push the price towards to our targets at 1.5147 (R2) and 1.5177 (R3) later on today. Downwards scenario: Our next support level lies at 1.5062 (S1). Clearance here might resume downtrend expansion. Our intraday target locates at 1.5031 (S2) and 1.5001 (S3). Resistance Levels: 1.5119, 1.5147, 1.5177 Support Levels: 1.5062, 1.5031, 1.5001 --------------------- USDJPY : HIGH 102.585 LOW 101.084 BID 101.480 ASK 101.482 CHANGE -0.52% TIME 08 : 17:54  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow from Japan, though a break of our resistance at 102.00 (R1) would suggest next targets at 102.35 (R2) and 102.70 (R3). Downwards scenario: A short-term technical structure might turn into negative side below the support level at 101.07 (S1). Possible price depreciation would then be targeting support at 100.76 (S2) en route to final target at 100.43 (S3). Resistance Levels: 102.00, 102.35, 102.70 Support Levels: 101.07, 100.76, 100.43 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Free Forex Demo Account | Forex Software | Forex Trading Blog | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 27 2013

Forex Technical & Market Analysis FXCC May 27 2013

EU gives the go-ahead to Spanish bank restructuring plan The European Commission announced on Wednesday its approval of the plans to restructure Spain's four nationalized banks: Bankia, Nova Caixa Galicia, Catalunya Caixa and Banco de Valencia. Vice President of the European Commission responsible for Competition Policy Joaquín Almunia said in the European morning that the injection of 37 billion euros of the bank rescue would require a 60% reduction in the size of the nationalized financial institutions by 2017. Joaquín Almunia informed that during the negotiations with Spanish authorities and the banks in question it was established that the recapitalization funds would be distributed as follows: 18 billion euros for Bankia, 9 billion for Catalunya Caixa, 5.5 billion for Nova Caixa Galicia and 4.5 billion for Banco de Valencia. The four nationalized financial institutions should abandon conceding loans for high risk activities and should transfer 45 billion euros of toxic assets to the newly created bad bank. Catalunya Caixa and Nova Caixa Galicia are expected to be sold before 2017. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-27-2013/[/url] FOREX ECONOMIC CALENDAR : 2012-11-29 08:55 GMT | Germany. Unemployment Change (Nov) 2012-11-29 10:30 GMT | United Kingdom. BoE's Governor King Speech 2012-11-29 13:30 GMT | United States. Gross Domestic Product Annualized (Q3) 2012-11-29 15:00 GMT | United States. Pending Home Sales (MoM) (Oct) FOREX NEWS : 2012-11-29 06:12 GMT | EUR/GBP flat below 0.8100, 50% Fibo 2012-11-29 05:36 GMT | GBP/USD trying to push higher, eyeing 1.6020 2012-11-29 05:25 GMT | NZD/USD higher on US 'fiscal cliff' optimism 2012-11-29 04:09 GMT | EUD/USD bullish while above 1.2885 – Scotiabank Forex Technical Analysis EURUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3). Resistance Levels: 1.2962, 1.2980, 1.2996 Support Levels: 1.2939, 1.2921, 1.2903 Forex Technical Analysis GBPUSD : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3). Resistance Levels: 1.6021, 1.6031, 1.6042 Support Levels: 1.6005, 1.5994, 1.5983 Forex Technical Analysis USDJPY : MARKET ANALYSIS – Intraday Analysis  Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3). Resistance Levels: 82.22, 82.30, 82.39 Support Levels: 82.00, 81.91, 81.82 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Currency Converter | Top ECN Forex Broker | Forex Demo Account | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 28 2013

Forex Technical & Market Analysis FXCC May 28 2013

As last week’s volatility in Japanese markets demonstrates central banks do not have it all their own way. Unfortunately for Japan the risk remains that policy makers spur higher yields without accompanying growth, an outcome that would be highly undesirable, especially if it hits economic activity. Equity markets and risk assets in general came under pressure and safe havens found long lost bids, with core bond yields moving lower and JPY and CHF strengthening. The heightened volatility in markets was also partly triggered by concerns about the timing of the tapering off of Fed asset purchases, with Fed Chairman Bernanke setting the cat amongst the pigeons by with commenting about the possibility of reducing asset purchases over the next few meetings. Additionally weaker than forecast Chinese manufacturing confidence data came as another blow to markets. While the market reaction looked a tad overdone in it is notable that the dichotomy between growth and equity market performance has widened over recent weeks. This week is likely to begin on a calmer note, with holidays in the US and UK today. Data releases in the US will remain encouraging , with May consumer confidence likely to move higher although US Q1 GDP is likely to be revised slightly lower to 2.4% due an inventories hit. In Europe, while the trajectory of recovery is starting from a much lower base there will be some improvement in business confidence in May while inflation will be well contained at 1.3% YoY in May, an outcome that will maintain room for more European Central Bank policy easing. In Japan a sixth straight negative CPI reading will highlight jus how difficult the job is for the Bank of Japan to meet its inflation target. The JPY was a major beneficiary of last week’s volatility helped by short covering as speculative positioning in the currency reached its lowest level since July 2007. A calmer tone to markets ought to ensure that JPY upside will be limited and USD buyers are likely to emerge just below the USD/JPY 100 level. In contrast the EUR has been surprisingly well behaved despite the fact that speculative EUR positioning has also dropped sharply over recent weeks. While the overall trend is lower EUR/USD will find some support on any dip to around 1.2795 this week. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-28-2013/[/url] FOREX ECONOMIC CALENDAR 2013-05-28 06:00 GMT Switzerland. Trade Balance (Apr) 2013-05-28 07:15 GMT Switzerland. Employment Level (QoQ) 2013-05-28 14:00 GMT USA. Consumer Confidence (May) 2013-05-28 23:50 GMT Japan. Retail Trade (YoY) (Apr) FOREX NEWS 2013-05-28 05:22 GMT USD/JPY offered at 102 figure 2013-05-28 04:23 GMT Bearish chart pattern developments still favor further downside in EUR/USD 2013-05-28 04:17 GMT AUD/USD erased all loses, back above 0.9630 2013-05-28 03:31 GMT GBP/USD chopping around 1.5100 in Asia trade Forex Technical Analysis EURUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Recently pair gained momentum on the downside however appreciation above the next resistance at 1.2937 (R1) might be a good catalyst for a recovery action towards to next expected targets at 1.2951 (R2) and 1.2965 (R3). Downwards scenario: Any downside penetration is limited now to the initial support level at 1.2883 (S1). A breach of which would open a route towards to next target at 1.2870 (S2) and potentially could expose our final support at 1.2856 (S3) later on today. Resistance Levels: 1.2937, 1.2951, 1.2965 Support Levels: 1.2883, 1.2870, 1.2856 Forex Technical Analysis GBPUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: New portion of macroeconomic data releases might increase volatility later on today. Our resistances at 1.5139 (R2) and 1.5162 (R3) could be exposed in case of possible upwards penetration. But first, price is required to overcome our key resistive barrier at 1.5117 (R1). Downwards scenario: Downside development remains for now limited to the next technical mark at 1.5085 (S1), clearance here would create a signal of possible market weakening towards to next expected targets at 1.5063 (S2) and 1.5040 (S3). Resistance Levels: 1.5117, 1.5139, 1.5162 Support Levels: 1.5085, 1.5063, 1.5040 Forex Technical Analysis USDJPY MARKET ANALYSIS – Intraday Analysis  Upwards scenario: USDJPY upwards penetration is approaching our next resistive barrier at 102.14 (R1). Surpassing of this level may initiate bullish pressure towards to next visible targets at 102.41 (R2) and 102.68 (R3). Downwards scenario: Risk of possible corrective action is seen below the support at 101.65 (S1). With penetration here opens a route towards to our immediate support level at 101.39 (S2) and any further price cut would then be limited to final target at 101.10 (S3). Resistance Levels: 102.14, 102.41, 102.68 Support Levels: 101.65, 101.39, 101.10 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] FX Central Clearing Ltd [/url] ) |

Forex Technical & Market Analysis FXCC May 29 2013

Forex Technical & Market Analysis FXCC May 29 2013

EUR Succumbs to Rise in U.S. Yields Demand for U.S. dollars kept pressure on the euro and all major currencies throughout the North American session. Between the recovery in U.S. stocks and the surge in U.S. yields, the dollar is one of the most coveted currencies. Even though we haven’t seen a major pickup in foreign demand for U.S. dollars, particularly from Japan, the longer U.S. yields hold above 2% (10 year yields are at 2.15%), the more tempting it will be for foreign investors. The lack of U.S. data at the front of the week means the lack of threat to the dollar rally. As long as the good news continues to flow in, the dollar will remain in demand. How well the greenback performs against various currencies will of course depend on how economic data from those countries fare. We have seen some recent improvements in Eurozone data that reduces the chance of additional easing by the European Central Bank. German labor market numbers are scheduled for release tomorrow and an upside surprise will keep the EUR above 1.28. The main driver of EUR/USD weakness has been the divergence between U.S. and Eurozone data – one was improving as the other was deteriorating. If we start to see improvements in the Eurozone economy, then the dynamics affecting the euro will start to change to benefit of the currency. Unfortunately based on the latest PMI numbers, there’s a risk of a downside surprise. According to the report, staffing levels fell for the first time since January with job shedding seen in both the manufacturing and service sectors. If unemployment rolls climb in the month of May, the EUR/USD could extend its losses but even then, the losses could be contained to 1.28, a level that has held for the past month. We probably need to see back to back weakness in Eurozone data (German unemployment and retail sales) for 1.28 to be broken. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-29-2013/[/url] FOREX ECONOMIC CALENDAR 2013-05-29 07:55 GMT Germany. Unemployment Change (May) 2013-05-29 12:00 GMT Germany. Consumer Price Index (YoY) (May) 2013-05-29 14:00 GMT Canada. BoC Interest Rate Decision 2013-05-29 23:50 GMT Japan. Foreign bond investment FOREX NEWS 2013-05-29 04:41 GMT Sterling hovering above critical support at 1.5000 2013-05-29 04:41 GMT USD unchanged; IMF lowers China GDP forecast 2013-05-29 04:16 GMT EUR/USD technical picture continues to sour, more declines to come? 2013-05-29 03:37 GMT AUD/JPY continues to find firm bids near 97.00 Forex Technical Analysis EURUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Our medium-term outlook is shifted to the negative side after the losses provided yesterday, however market appreciation is possible above the next resistance at 1.2880 (R1). Loss here would suggest next intraday targets at 1.2899 (R2) and 1.2917 (R3). Downwards scenario: Fresh low at 1.2840 (S1) offers a key resistive measure on the downside. Break here is required to enable bearish pressure and validate next target at 1.2822 (S2). Final support for today locates at 1.2803 (S3). Resistance Levels: 1.2880, 1.2899, 1.2917 Support Levels: 1.2840, 1.2822, 1.2803 Forex Technical Analysis GBPUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Our attention on the upside is put to the next resistive barrier at 1.5052 (R1). Break here is required to stimulate bullish forces to expose initial targets at 1.5078 (R2) and 1.5104 (R3) later on today. Downwards scenario: On the other hand, break below the support at 1.5014 (S1) is required to enable further market decline. Our next supportive measures locates at 1.4990 (S2) and 1.4967 (S3). Resistance Levels: 1.5052, 1.5078, 1.5104 Support Levels: 1.5014, 1.4990, 1.4967 Forex Technical Analysis USDJPY MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Further upwards penetration above the resistance at 102.53 (R1) would enable bullish forces and might drive market price towards to our initial targets at 102.70 (R2) and 102.89 (R3). Downwards scenario: On the other hand, prolonged movement below the initial support level at 102.01 (S1) might trigger protective orders execution and drive market price towards to supportive means at 101.82 (S2) and 101.61 (S3). Resistance Levels: 102.53, 102.70, 102.89 Support Levels: 102.01, 101.82, 101.61 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Forex Trading Education | ECN Trading Forex Account | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 30 2013

Forex Technical & Market Analysis FXCC May 30 2013

OECD: Global economy is moving forward at multiple speeds In its biannual Economic Outlook report, published on Wednesday, the Organization for Economic Cooperation and Development reduced the global growth outlook to 3.1% from the previous estimate of 3.4%. It expects the US and the Japanese economies to improve this year, suggesting at the same time that the Eurozone will continue to lag which might have “negative implications for the global economy." The OECD cut the Eurozone growth forecast to -0.6% from -0.1% estimated in November 2012, warning that "activity is still falling, reflecting ongoing fiscal consolidation, weak confidence and tight credit conditions, especially in the periphery." The Eurozone economy should rebound to 1.1% in 2014. The OECD also urged the ECB to seriously consider implementing QE and introducing negative deposit rates in order to stimulate recovery in the area. China, which already saw its growth outlook reduced on Tuesday by the IMF, is expected to grow by 7.8% this year, down from a previous estimate of 8.5%. The organization was more upbeat about the US, which is projected to grow by 1.9% in 2013 and by 2.8% in 2014. Japan's growth forecast was hiked to 1.6% from 0.7%, with the prospect of a 1.4% gain next year, owing to the BoJ's implementation of fiscal and monetary stimulus programs. [url]http://blog.fxcc.com/forex-technical-market-analysis-may-30-2013/[/url] FOREX ECONOMIC CALENDAR 2013-05-30 06:00 GMT UK. Nationwide Housing Prices n.s.a (YoY) (May) 2013-05-30 12:30 GMT USA. Gross Domestic Product Price Index 2013-05-30 14:30 GMT USA. Pending Home Sales (YoY) (Apr) 2013-05-30 23:30 GMT Japan. National Consumer Price Index (YoY) (Apr) FOREX NEWS 2013-05-30 04:39 GMT USD eases to key level at 83.50 ahead of US GDP 2013-05-30 03:11 GMT GBP/USD – Bullish engulfing candle to spur further advances? 2013-05-30 02:29 GMT EUR/USD edging towards resistance at 1.3000 2013-05-30 01:50 GMT Aussie edging higher towards resistance at 0.9700 Forex Technical Analysis EURUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: Recent upside penetration is limited now to the key resistive barrier at 1.2977 (R1). Appreciation above this mark might likely push the pair toward to next targets at 1.2991 (R2) and 1.3006 (R3) in potential. Downwards scenario: Possible bull back on the hourly chart might face next hurdle at 1.2933 (S1). Break here is required to open road towards to our next retracement target at 1.2919 (S2) en route to final aim at 1.2902 (S3). Resistance Levels: 1.2977, 1.2991, 1.3006 Support Levels: 1.2933, 1.2919, 1.2902 Forex Technical Analysis GBPUSD MARKET ANALYSIS – Intraday Analysis  Upwards scenario: A bullish oriented market participant might pressures to test our next resistance level at 1.5165 (R1). Loss here could open a route towards to our interim target at 1.5188 (R2) and the main aim for today locates at 1.5211 (R3). Downwards scenario: As long as price stays below the moving averages our medium-term outlook would be negative. Though, extension lower the 1.5099 (S1) is being able to drive market price towards to our next supports at 1.5076 (S2) and 1.5053 (S3). Resistance Levels: 1.5165, 1.5188, 1.5211 Support Levels: 1.5099, 1.5076, 1.5053 Forex Technical Analysis USDJPY MARKET ANALYSIS – Intraday Analysis  Upwards scenario: USDJPY recently tested negative side and currently remains stable below the 20 SMA. Possible price appreciation is limited to the resistance level at 101.53 (R1). Only clear break here would suggest next intraday targets at 101.81 (R2) and 102.09 (R3). Downwards scenario: Any prolonged movement below the support at 100.60 (S1) might prolong downside pressure and drive market price towards to supportive means at 100.34 (S2) and 100.08 (S3). Resistance Levels: 101.53, 101.81, 102.09 Support Levels: 100.60, 100.34, 100.08 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Currency Converter | Forex ECN Broker | Forex Demo Account |FXCC [/url] ) |

Forex Technical & Market Analysis FXCC May 31 2013

Forex Technical & Market Analysis FXCC May 31 2013

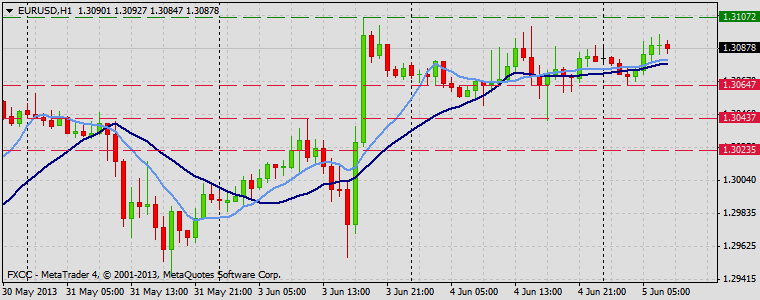

Will the Dollar Recover Too? U.S. stocks and Treasury yields resumed their rise but the dollar failed to follow. Instead of trading higher, the greenback lost value against most of the major currencies. The EUR/USD rose above 1.30 and USD/JPY slipped below 101 after a round of weaker than expected economic data. Equity and fixed income traders shrugged off the data but FX traders refused to budge. Long dollar positions are still being cut which suggests that currency traders are still worried about the volatility in the financial markets and the eagerness of the Fed to taper asset purchases. U.S. equity and fixed income traders have completely ignored the 5% drop in the Nikkei overnight. Japanese stocks are 13% off its highs and if it continues to decline, it may have ripple effects over to U.S. markets and keep the dollar in corrective mode. However if the Nikkei stabilizes and starts to recover, then the dollar has a chance of joining the recovery. [url]https://support.fxcc.com/email/technical/31052013/[/url] FOREX ECONOMIC CALENDAR 2013-05-31 08:30 GMT UK. Net Lending to Individuals (MoM) 2013-05-31 09:00 GMT EMU. Consumer Price Index - Core (YoY) 2013-05-31 12:30 GMT USA. Personal Spending (Apr) 2013-05-31 13:55 GMT USA. Reuters/Michigan Consumer Sentiment Index (May) FOREX NEWS 2013-05-31 04:01 GMT ‘Pennant’ pattern break out on EUR/USD targets a move north of 1.3200 2013-05-31 03:43 GMT Aussie advances capped below 0.9700 2013-05-31 02:30 GMT EUR/AUD off fresh 1.5-year highs below 1.35 2013-05-31 01:53 GMT AUD/JPY firm bounce off 97.00 support, sets eyes on 98.30 --------------------- Forex Technical Analysis EURUSD MARKET ANALYSIS – Intraday Analysis  HIGH 1.30593 LOW 1.30312 BID 1.30405 ASK 1.30410 CHANGE -0.06% TIME 08 : 39:18 OUTLOOK SUMMARY Up TREND CONDITION Up trend TRADERS SENTIMENT Bearish IMPLIED VOLATILITY Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Further bullish momentum might occur if the price manages to climb above the key resistance level at 1.3061 (R1). Next targets on the way could be exposed at 1.3081 (R2) and 1.3101 (R3). Downwards scenario: On the other hand, corrective action would be reasonable scenario in current price setup. Next on tap is seen support level at 1.3026 (S1), break here is required to enable our initial targets at 1.3006 (S2) and 1.2987 (S3) Resistance Levels: 1.3061, 1.3081, 1.3101 Support Levels: 1.3026, 1.3006, 1.2987 --------------------- Forex Technical Analysis GBPUSD MARKET ANALYSIS – Intraday Analysis  HIGH 1.52392 LOW 1.52151 BID 1.52260 ASK 1.52269 CHANGE -0.02% TIME 08 : 39:19 OUTLOOK SUMMARY Up TREND CONDITION Up trend TRADERS SENTIMENT Bullish IMPLIED VOLATILITY Medium Upwards scenario: An evidence of further uptrend formation could be provided if the pair manages to surpass key resistive barrier at 1.5239 (R1). Execution of protective orders above that level might enable initial targets at 1.5257 (R1) and 1.5274 (R3). Downwards scenario: Recent upside momentum likely exhausted and we expect some stabilization ahead. Next supportive bastion lies at 1.5211 (S1). Prolonged movement below it might then expose our intraday targets at 1.5193 (S2) and 1.5176 (S3). Resistance Levels: 1.5239, 1.5257, 1.5274 Support Levels: 1.5211, 1.5193, 1.5176 -------------------------- Forex Technical Analysis USDJPY MARKET ANALYSIS – Intraday Analysis  HIGH 101.281 LOW 100.679 BID 100.871 ASK 100.874 CHANGE 0.15% TIME 08 : 39:20 OUTLOOK SUMMARY Down TREND CONDITION Sideway TRADERS SENTIMENT Bullish IMPLIED VOLATILITY Medium Upwards scenario: Price has comfortably ranged on the hourly timeframe however we see potential to overcome our next resistance level at 101.30 (R1) later on today. Our eventual targets locates at 101.60 (R2) and 101.90 (R3). Downwards scenario: If the price failed to gain momentum on the upside we expect retest of our key support level at 100.47 (S1). Clearance here is required to keep the downside extension intact and enable our lower targets at 100.16 (S2) and 99.87 (S3). Resistance Levels: 101.30, 101.60, 101.90 Support Levels: 100.47, 100.16, 99.87 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] ) |

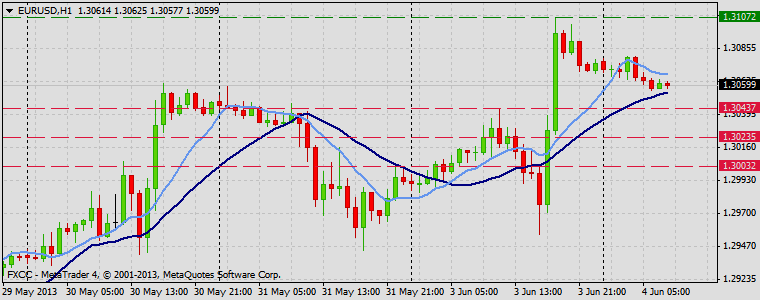

Forex Technical & Market Analysis FXCC Jun 04 2013

Forex Technical & Market Analysis FXCC Jun 04 2013

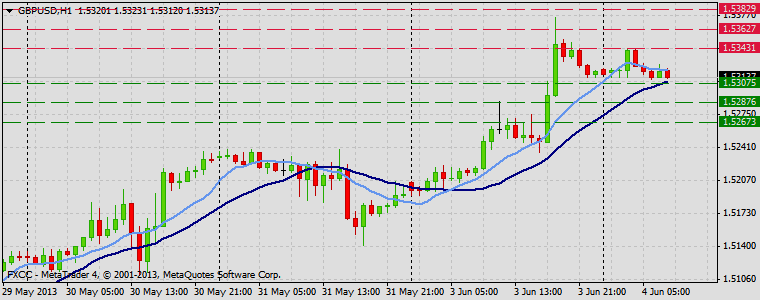

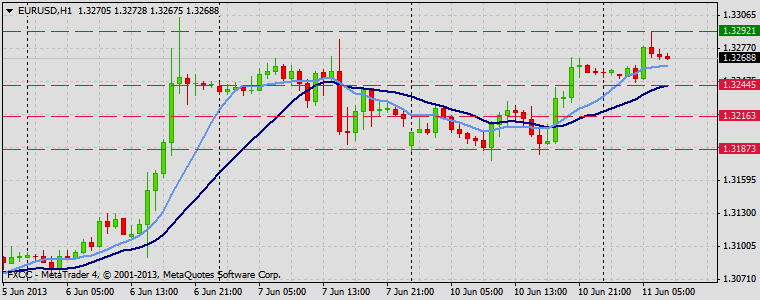

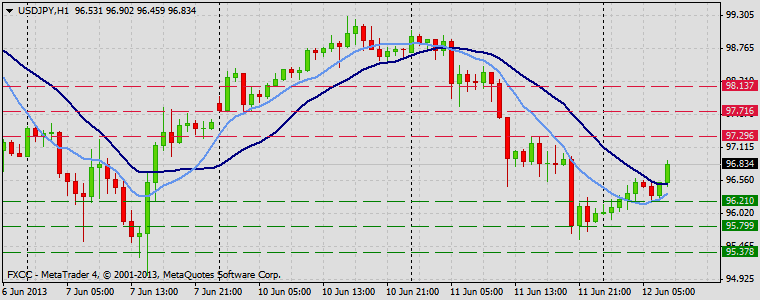

Fitch cuts Cyprus to B-, negative outlook Fitch Ratings has downgraded Cyprus's long-term foreign currency issuer default rating by one notch to 'B-' from 'B' while keeping a negative outlook due to the country's elevated economic uncertainty. The rating agency had placed Cyprus on negative watch in March. With this decision, Fitch pushed Cyprus further into junk territory, now 6 notches. "Cyprus has no flexibility to deal with domestic or external shocks and there is a high risk of the (EU/IMF) program going off track, with financing buffers potentially insufficient to absorb material fiscal and economic slippage," Fitch said in a statement. The EUR/USD finished the day sharply higher, at one point trading all the way up to 1.3107 before leaking lower later in the day to close up 76 pips at 1.3070. Some analysts were pointing towards weaker than expected ISM data from the US as the main catalyst for the bullish move in the pair. Economic data out of the US will slow down a bit the next few days, but volatility is certain to pick up as we approach the ECB Rate Decision on Thursday, as well as the Non-Farm Payrolls number due out of the US on Friday. [url]https://support.fxcc.com/email/technical/04062013/[/url] FOREX ECONOMIC CALENDAR : 2013-06-04 08:30 GMT | UK. PMI Construction (May) 2013-06-04 09:00 GMT | EMU. Producer Price Index (YoY) (Apr) 2013-06-04 12:30 GMT | USA. Trade Balance (Apr) 2013-06-04 23:30 GMT | Australia. AiG Performance of Services Index (May) FOREX NEWS : 2013-06-04 04:30 GMT | RBA Interest Rate Decision stays unchanged at 2.75% 2013-06-04 03:20 GMT | Will economic data later in week free EUR/USD from range bound behavior? 2013-06-04 02:13 GMT | EUR/AUD finds some ground in the 1.34 round area 2013-06-04 02:00 GMT | AUD/JPY advances capped below 97.50 ------------------------ EURUSD : HIGH 1.30804 LOW 1.30566 BID 1.30572 ASK 1.30575 CHANGE -0.14% TIME 08 : 22:51  OUTLOOK SUMMARY Up TREND CONDITION Upward penetration TRADERS SENTIMENT Bearish IMPLIED VOLATILITY Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: While price is quoted above the 20 SMA, our technical outlook would be positive. Yesterday high offers next resistance level at 1.3107 (R1). Any price action above it would suggest next targets at 1.3127 (R2) and 1.3147(S3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.3043 (S1). Possible price regress could expose our initial targets at 1.3023 (S2) and 1.3003 (S3) in potential. Resistance Levels: 1.3107, 1.3127, 1.3147 Support Levels: 1.3043, 1.3023, 1.3003 ----------------------- GBPUSD : HIGH 1.53427 LOW 1.53101 BID 1.53115 ASK 1.53119 CHANGE -0.05% TIME 08 : 22:52  OUTLOOK SUMMARY Up TREND CONDITION Up trend TRADERS SENTIMENT Bearish IMPLIED VOLATILITY Medium Upwards scenario: Next barrier on the upside lie at 1.5343 (R1). Surpassing of this level might enable our initial target at 1.5362 (R2) and any further gains would then be limited to last resistive structure at 1.5382 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5307 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5287 (S2) and 1.5267 (S3). Resistance Levels: 1.5343, 1.5362, 1.5382 Support Levels: 1.5307, 1.5287, 1.5267 ---------------------- USDJPY : HIGH 99.88 LOW 99.333 BID 99.838 ASK 99.839 CHANGE 0.31% TIME 08 : 22:52  OUTLOOK SUMMARY Down TREND CONDITION Upward penetration TRADERS SENTIMENT Bullish IMPLIED VOLATILITY Medium Upwards scenario: Possible bullish penetration might face next challenge at 100.02 (R1). Break here is required to establish retracement action, targeting 100.32 (R2) en route towards to last resistance for today at 100.65 (R3). Downwards scenario: Penetration below the support at 99.31 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 99.04 (S2) and 98.75 (S3) might be triggered. Resistance Levels: 100.02, 100.32, 100.65 Support Levels: 99.31, 99.04, 98.75 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Forex Training | Best Automatic Forex Trading Platforms | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC Jun 05 2013

Forex Technical & Market Analysis FXCC Jun 05 2013

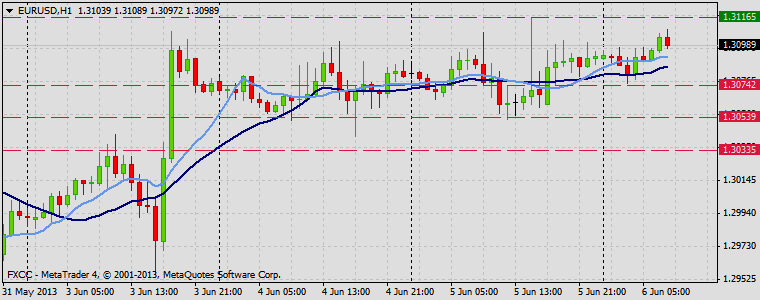

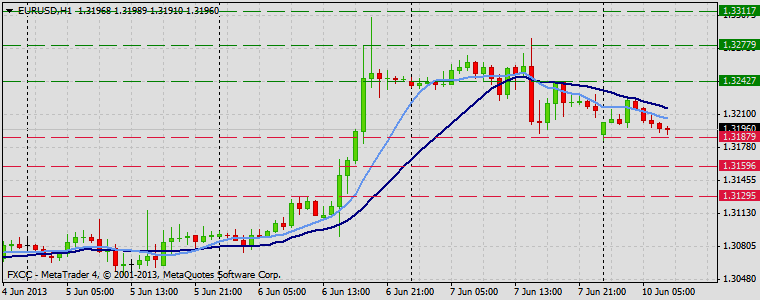

IMF's Lagarde urges Greece not to relax bailout efforts MF head Christine Lagarde said in an interview for the Greek state TV on Tuesday that the country was making progress on its bailout program but that it nevertheless should increase efforts to combat tax evasion and implement reforms to attract foreign investors. 'Now is not the time to relax the effort,' Lagarde said, adding that "There are some really positive developments but obviously more needs to be done.” She listed tax evasion and reforms to spur foreign investment as the most important issues which need to be dealt with. This week EU, ECB and IMG inspectors return to Athens for another revision of the Greek bailout program, during which they are expected to focus on the Greek government's progress in reducing state employee numbers. The EUR/USD traded in a narrow range today but still managed to finish the day in positive territory, closing up 11 pips at 1.3081. Economic data out of the both the EU and US was light, but will pick up as we approach the end of the week with the ECB Interest Rate Decision on Thursday, as well as US Non Farm Payrolls on Friday. However, before the real fireworks begin, some analysts are pointing to tomorrow’s ADP data out of the US as a possible catalyst for tomorrow’s price action. According to Sean Callow at Westpac, “we have the ADP report plus non manufacturing ISM jobs components tonight. There is a great deal of focus on jobs data in the US given recent speculation about Fed tapering its asset purchase programs. ADP disappointed in April but has not had much directional success in picking payrolls outcomes. The ISM report on Monday casts a long shadow over tonight's non manufacturing report. Arguably, markets will be set up for a softer outcome given the weaker US$ in recent sessions. Tonight's data could prove to be important for FX markets.” [url]https://support.fxcc.com/email/technical/05062013/[/url] FOREX ECONOMIC CALENDAR : 2013-06-05 08:28 GMT | UK. Markit Services PMI (May) 2013-06-05 09:00 GMT | EMU. Gross Domestic Product 2013-06-05 14:00 GMT | USA. ISM Non-Manufacturing PMI (May) 2013-06-05 18:00 GMT | USA. Fed's Beige Book FOREX NEWS : 2013-06-05 05:11 GMT | USD/JPY back below 100; Australia GDP disappoints 2013-06-05 04:39 GMT | AUD/JPY searching for bids near 96.00 2013-06-05 03:26 GMT | EUR/USD technical indicators beginning to look more constructive 2013-06-05 01:46 GMT | AUD/USD breaking lower towards 0.9600 after Aussie GDP data --------------------------- EURUSD : HIGH 1.30964 LOW 1.30653 BID 1.30899 ASK 1.30903 CHANGE 0.08% TIME 08 : 56:44  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: We are not expecting significant volatility increase today however upside risk aversion is seen above the next resistance level at 1.3107 (R1). Price evaluation above this level would suggest next targets at 1.3127 (R2) and 1.3147 (R3). Downwards scenario: While instrument trades above the moving averages, our short-term bias would stay positive though penetration below the support level at 1.3064 (S1) might open way towards to lower targets at 1.3043 (S2) and 1.3023 (S3). Resistance Levels: 1.3107, 1.3127, 1.3147 Support Levels: 1.3064, 1.3043, 1.3023 ---------------------- GBPUSD : HIGH 1.53379 LOW 1.52912 BID 1.53331 ASK 1.53336 CHANGE 0.14% TIME 08 : 56:45  OUTLOOK SUMMARY : Up TREND CONDITION : Upward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Medium- term tendency remains bullish as both moving averages are pointing up. Further progress above the resistance level at 1.5343 (R1) would open way towards to next targets at 1.5362 (R2) and 1.5382 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 1.5307 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 1.5287 (S2) and 1.5267 (S3) later on. Resistance Levels: 1.5343, 1.5362, 1.5382 Support Levels: 1.5307, 1.5287, 1.5267 -------------------- USDJPY : HIGH 100.462 LOW 99.385 BID 99.592 ASK 99.597 CHANGE -0.48% TIME 08 : 56:46  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: We see potential to test our resistive barrier at 99.75 (R1). Successful penetration above this mark might shift traders sentiment to the bullish side and validate our intraday targets at 100.02 (R2) and 100.32 (R3). Downwards scenario: Further downtrend development is limited now to the key supportive barrier at 99.31 (S1). Only loss here would enable our intraday targets at 99.04 (S2) and 98.75 (S3) on the downside. Resistance Levels: 99.75, 100.02, 100.32 Support Levels: 99.31, 99.04, 98.75 Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] Forex ECN Brokers List | Auto Forex Trading Account | FXCC [/url] ) |

Forex Technical & Market Analysis FXCC Jun 06 2013

Forex Technical & Market Analysis FXCC Jun 06 2013