Forex Technical & Market Analysis FXCC Jun 11 2013

Forex Technical & Market Analysis FXCC Jun 11 2013

Forex Technical & Market Analysis FXCC Jun 11 2013

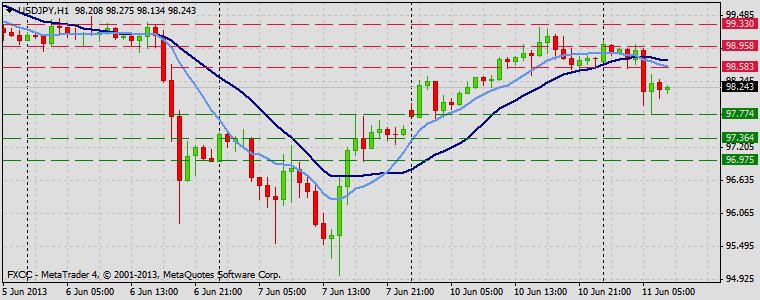

USD/JPY searching for direction after BoJ Meeting

The USD/JPY has experienced a fairly volatile Asia session, at one point declining all the way down to 97.78 before finding support and currently consolidating near the 98.30 level. The main catalyst for the sharp drop appeared to come right after the Bank of Japan announced they wouldn’t be making any changes to current monetary policy.

Analysts on the FXStreet.com team noted although many had expected the policy to remain unchanged, there were rumors circling of possible adjustments to help control the recent government bond market volatility which may have helped spark the initial declines when market participants saw the adjustments to current policy were not made. “The Bank of Japan monetary policy meeting offered no particular response to the latest episodes of market volatility in JGB, which includes the failure to change maturities of fixed rate operations in order to ease bond market volatility. Also, there had been some rumors about a proposal to extend the loans to 2 years, something that was not accepted, leading to a strong selling in both the Nikkei and USD/JPY,” FXstreet.com team concluded.

[url]https://support.fxcc.com/email/technical/11062013/[/url]

FOREX ECONOMIC CALENDAR :

N/A | Japan. BoJ Monetary Policy Statement

N/A | Germany. Germany Constitutional court ruling on OTM bond buying

2013-06-11 08:30 GMT | UK. Manufacturing Production

2013-06-11 14:00 GMT | UK. NIESR GDP Estimate

2013-06-11 05:00 GMT | USD/JPY searching for direction after BoJ Meeting

2013-06-11 04:43 GMT | 10% appreciation by the USD in 12-18 months - Societe Generale

2013-06-11 04:34 GMT | AUD/USD faces deeper falls on clean 0.94 breakout - JPMorgan

2013-06-11 04:01 GMT | GBP/USD possibly gunning for 1.5800 - 2ndSkies

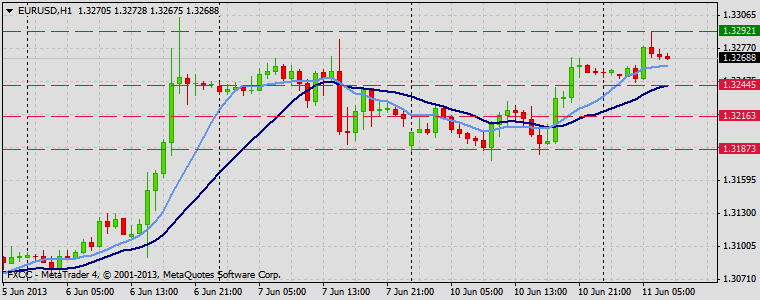

EURUSD :

HIGH 1.32917 LOW 1.32474 BID 1.32702 ASK 1.32705 CHANGE 0.11% TIME 08 : 27:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market remains relatively stable, though clearance of next resistance level at 1.3292 (R1) might initiates bullish pressure. Above the local high locates our resistive means at 1.3321 (R2) and 1.3350 (R3). Downwards scenario: Activation of bearish forces is possible below the support level at 1.3244 (S1). Clearance here would suggest next interim target at 1.3216 (S2) and if the price holds its momentum we would suggest final aim at 1.3187 (S3).

Resistance Levels: 1.3292, 1.3321, 1.3350

Support Levels: 1.3244, 1.3216, 1.3187

----------------------

GBPUSD :

HIGH 1.5602 LOW 1.55563 BID 1.55820 ASK 1.55825 CHANGE 0.06% TIME 08 : 27:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Resistance level at 1.5602 (R1) acts as reference point for further market strengthening. Break here is required to enable next interim target at 1.5635 (R2) en route towards to final aim for today at 1.5667 (R3). Downwards scenario: Though, possibility of correction is high. Devaluation below the support at 1.5552 (S1) would initiate bearish pressure. On the way our next interim support at 1.5521 (S2) en route to final target at 1.5488 (S3).

Resistance Levels: 1.5602, 1.5635, 1.5667

Support Levels: 1.5552, 1.5521, 1.5488

--------------------

USDJPY :

HIGH 99.056 LOW 97.791 BID 98.226 ASK 98.231 CHANGE -0.52% TIME 08 : 27:26

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY commence correction phase and currently any upside action is limited to the next resistive structure at 98.58 (R1). Break here is required to enable upside pressure towards to intraday targets at 98.95 (R2) and 99.33 (R3). Downwards scenario: Prolonged movement below the supportive measure at 97.77 (S1) is required to activate downtrend expansion. Next aim on the way would be mark at 97.36 (S2) and then final target could be met at 96.97 (S3).

Resistance Levels: 98.58, 98.95, 99.33

Support Levels: 97.77, 97.36, 96.97

Source: FX Central Clearing Ltd,( [url=http://www.fxcc.com] http://www.fxcc.com [/url] )

|